Scalable Business Model

Proven Experience

Having long-standing experience in banking software development services, we understand the growing importance of data security and regulatory compliance.

By providing our customers with progressive risk analytics and compliance solutions, our banking app developers ensure meeting regulatory requirements without any hidden expenses.We use advanced encryption standards to protect all sensitive data such as passwords, personal identification and financial information from unauthorized access. Multi-factor authentication combined with access controls adds an extra layer of security and regular testing and updates allow us to fix potential security vulnerabilities before they can be exploited.

Founder,

Cryptocurrency Company

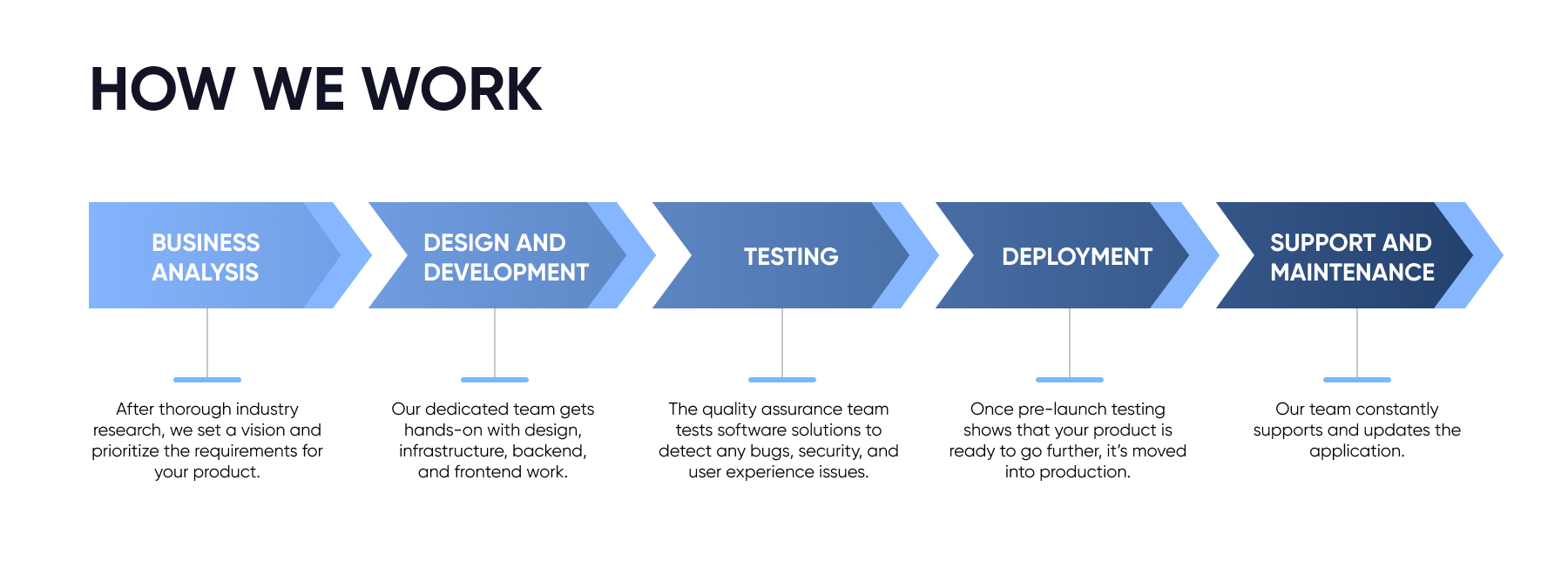

The timeline for building banking software systems can vary depending on different factors such as the scope and complexity of the system, the technology stack used, the size of the development team, and the level of customization required.

A simple online banking system with basic features might take around 6-9 months, while a more complex system that includes features such as fraud detection, loan processing, and risk management might take 2-3 years or more.