The banking sector and the capital market are undergoing the influence of Fintech every year to a bigger extent. In 2018, venture capital-backed Fintech companies raised more than $40 billion in funding and achieved greater inclusion in 2022.

Though some believed that Fintech would disrupt banking completely in the near future, the biggest threat to most of the banks appeared to come not from Fintech itself but from being stuck to traditional banking while the competitors have already started taking the advantage of fintech software development services. The potential threat of losing a significant market share and being driven into irrelevance made most of the financial services institutions take up the revolutionary technology and enter the new phase of financial services industry evolution. The majority of IT companies started offering their expertise in the development and maintenance of custom financial software for Fintech startups and large-scale companies to gain greater efficiency, industry knowledge, and to cash out.

Biometrics as a new standard of internet banking

Passwords remain a popular tool, yet biometrics development makes this example of traditional banking one step closer to being obsolete. Who needs a 16-character password that has to include lower and upper-case letters, numbers, and signs like $, # and more? Especially when the authentication can be completed within milliseconds after scanning your fingerprints or iris. Here’s a small list of what biometrics is capable at the moment:

- Iris scan;

- Fingerprint scan;

- Voice authentication;

- Facial recognition;

- Vein scan (either hand or eyeball);

- Internal data (glucose level, heartbeat, other parameters);

Fingerprint scan is by far the most common thing on the market, as many middle-class or lower-budget smartphones already include this function. The latest iterations of Apple’s iPhones, Samsung’s Galaxy S9s, and a range of Chinese devices are already capable of scanning the user’s face and/or eyes to prove the identity.

Forrester survey reveals that 61% of Singaporean financial institutions have already incorporated biometrics, such as fingerprints, iris, and voice scans.

Fintech has gone even further. PayPal, one of the innovative Fintech startups, originally co-founded by Elon Musk is calling iris scans “too old” already. The company offers silicone chips that go beneath the user’s skin. These chips scan the parameters like glucose level, vein patterns, heartbeat, and more to provide multi-factor authentication for any activity that requires additional security.

Blockchain for transparency, data management, and instant transfers

Distributed leader technologies, widely known as blockchains, have already moved from the shade of public interest and now are treated as paradigm-changing technologies that turn the interaction between Fintech and banks upside down. The research held by Accenture shows that 9 in 10 executives are considering the implementation of blockchain technology into their financial services.

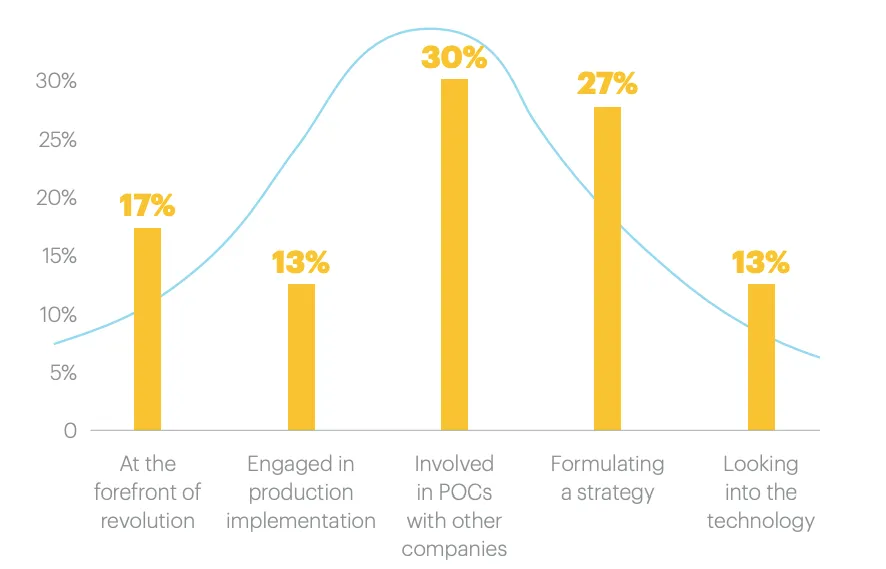

Here's bank’s current stage in blockchain adoption.

_1758804763-small.webp)