The entire world has gone mobile. Looking at the speed at which financial institutions and companies and are adopting digital solutions, it probably won’t be a mistake to assume that in the near future, we will live in a completely cashless world.

Fintech apps have played a game-changing role in this revolution. They made payments easier, transactions more secure, and lending attainable at our fingertips. They’ve put the whole range of financial and banking services directly in our pockets.

In today’s blog, we’ll explore 16 fintech applications that serve different purposes from saving to managing investment accounts, so you can choose the best fintech app as based on your individual needs.

FinTech Industry Size in 2026 - Let’s Look at The Statistics

The fintech industry is rapidly expanding, and 2026 is set to be a significant year for its explosive growth. Let’s have a look at some interesting statistics that highlight the impact of the fintech sector and market trends.

- According to Forbes, 59% of users rely on AI-driven services for making investment decisions, while only about one in seven express a lack of trust in these technologies.

- A McKinsey & Company report shows that integrating personalized experiences in finance software can boost mobile sales and increase user engagement. Personalization can drive revenue growth by up to 15%.

- Currently, fintech accounts for only 2% of global financial earnings, but by 2030, it's expected to reach $1.5 trillion, representing nearly a quarter of global banking values.

- As fintech grows, discussing finances is becoming less taboo. In fact, 63% of Americans say fintech has made it easier to talk about money and financial planning with friends.

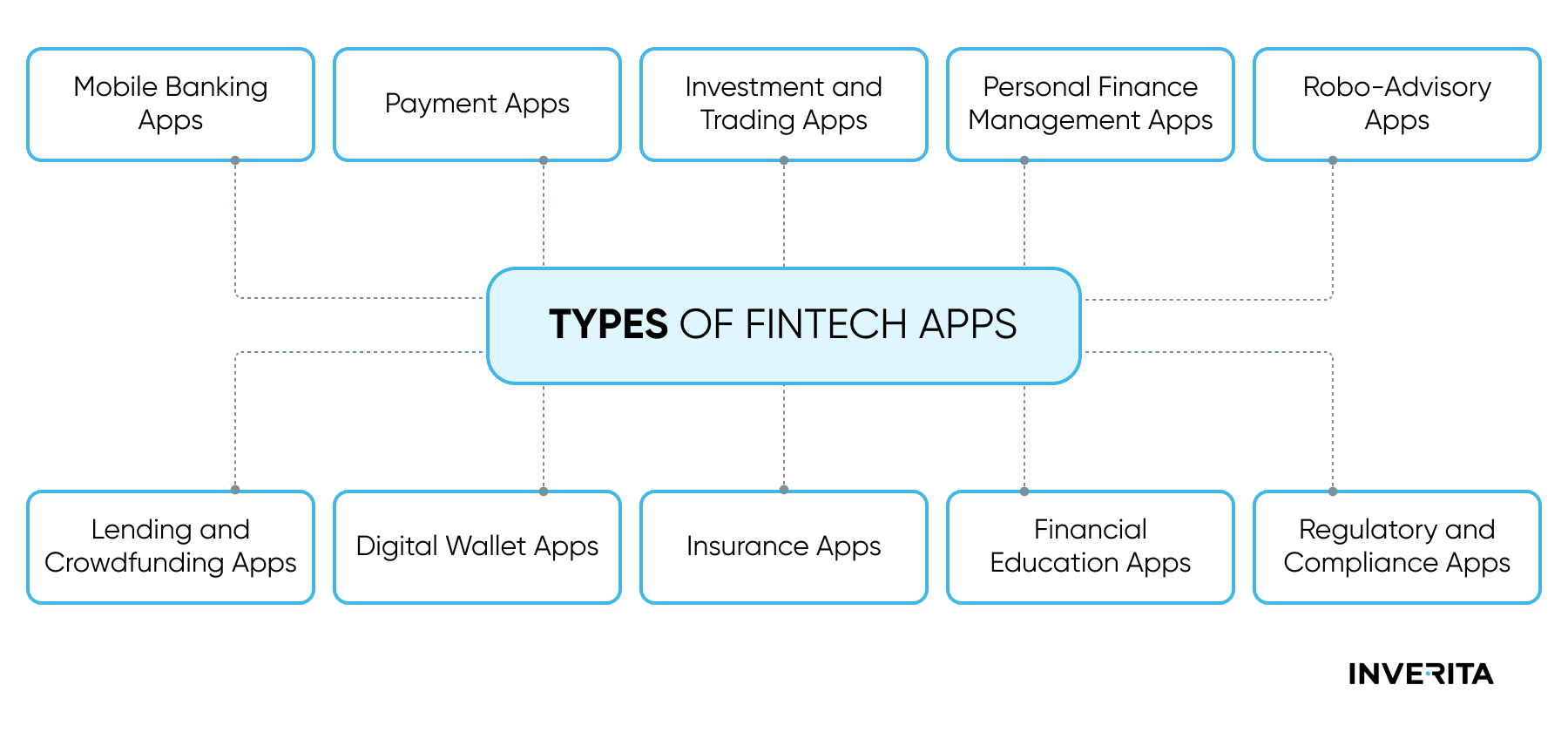

Types of Fintech Apps

Based on what you aim to achieve, there are different types of fintech apps.

Typically, they fall into five main categories:

- Digital Banking - fintech applications that provide online banking services, enabling app users to manage accounts, instant transfers, and more.

- Investments - these apps focus on investment personalized advice, offering tools for trading stocks, bonds, and other financial assets.

- Personal Finance - personal finance apps are designed to help users track expenses, create budgets, and manage savings to make the right financial decisions.

- Blockchain and Cryptocurrency - fintech applications that facilitate crypto transactions, manage wallets, or explore blockchain technologies.

- RegTech - regulatory technology apps help companies comply with financial regulations, automating compliance tasks to reduce risks.