Banking Apps

Banking apps have already become a part of our everyday lives, allowing us to easily manage accounts and perform various transactions at our fingertips. The basic features of banking applications include account balance checking, money transfers, mobile check deposit, and bill payment. A lot of banking apps also offer additional services such as account alerts, budgeting tools, and even the ability to apply for loans or credit cards. They also must include strong security measures such as biometric login and two-factor authentication to protect customers' sensitive information.

Insurance Apps

Insurance applications typically include features such as policy information, access to ID cards, claims submission and tracking, and the ability to view and pay bills. They also often include educational resources such as articles and videos about different types of insurance, and interactive tools such as quizzes to help customers understand their coverage options. Many insurance apps also offer additional services such as appointment scheduling, and the ability to connect with an agent or customer service representative directly through the app.

Lending Apps

Lending apps are becoming increasingly popular as a way to access quick and easy loans. These apps allow users to apply for loans from their smartphones, and often offer competitive interest rates and flexible repayment terms. They are a great option for those who need access to funds quickly, as the application process is often much faster than traditional loan applications. Additionally, many of these apps offer features such as budgeting tools and financial advice, making them a great resource for those looking to manage their finances.

Payment Apps

Payment apps are becoming increasingly popular as a convenient and secure way to make payments. They allow users to quickly and easily transfer money to friends, family, and businesses, without the need for cash or cards. Payment apps also offer additional features such as budgeting tools, rewards programs, and the ability to store payment information for future use.

Trading and Investing Apps

With trading and investing apps, users get the ability to manage their investments and trades with the help of their mobile devices. These apps provide users with access to real-time market data, the ability to place trades, and the ability to monitor their investments. They also offer a variety of features such as portfolio tracking, news and analysis, and educational resources.

Cryptocurrency Apps and Platforms

While more and more people are becoming interested in digital currencies, the popularity of this kind of application keeps rising. provide users with a secure and convenient way to buy, sell, and store their digital assets, offering a variety of features, such as real-time price tracking, portfolio management, and trading tools. Additionally, many of these apps and platforms offer educational resources to help users learn more about the cryptocurrency market.

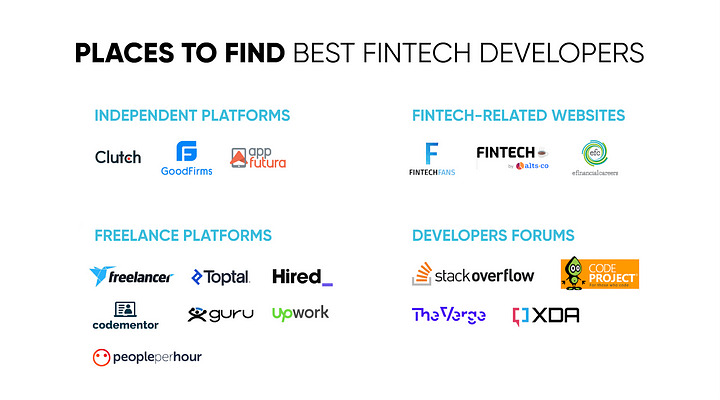

Where to Find Fintech Developers?

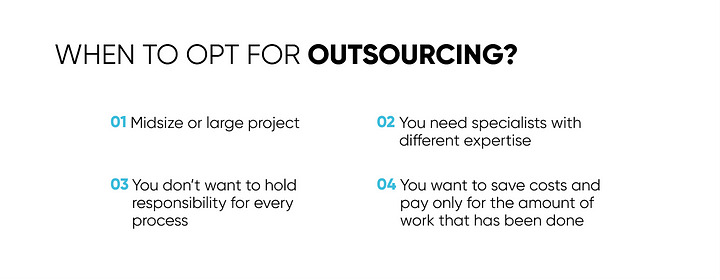

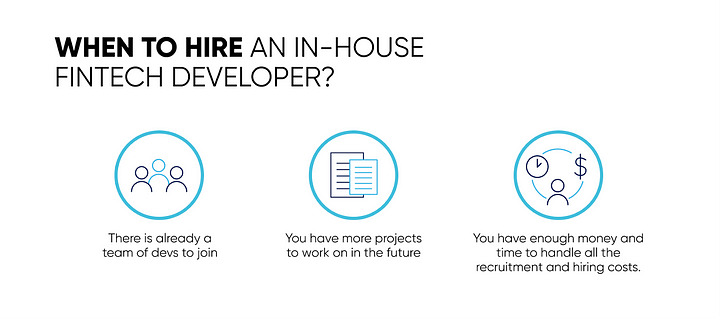

When hiring fintech software developers one needs to choose the cooperation model which will be the most beneficial for their fintech business. There are the following options:

Outsourcing Developers

The fintech dev provider is the offshore company that curates the development process instead of you. You don’t need to look for a fintech engineer with particular expertise, the company has it for your fintech products.

Pros of Outsourcing Fintech Development

- The approach is affordable, as you pay just for the amount of work that has been done. No extra expenses on recruitment, company perks, etc.;

- You receive access to a large talent pool - fintech developers with the expertise that is needed for your product;

- A vendor provides financial and legal support, business analysis, and post-development maintenance of the product;

- Such an approach is very time-efficient and allows business owners to concentrate on their core business.

Cons of Outsourcing Fintech Development

- In case of significant time zone difference, there might be difficulties in communication;

- You don’t have full-time control over the development process.