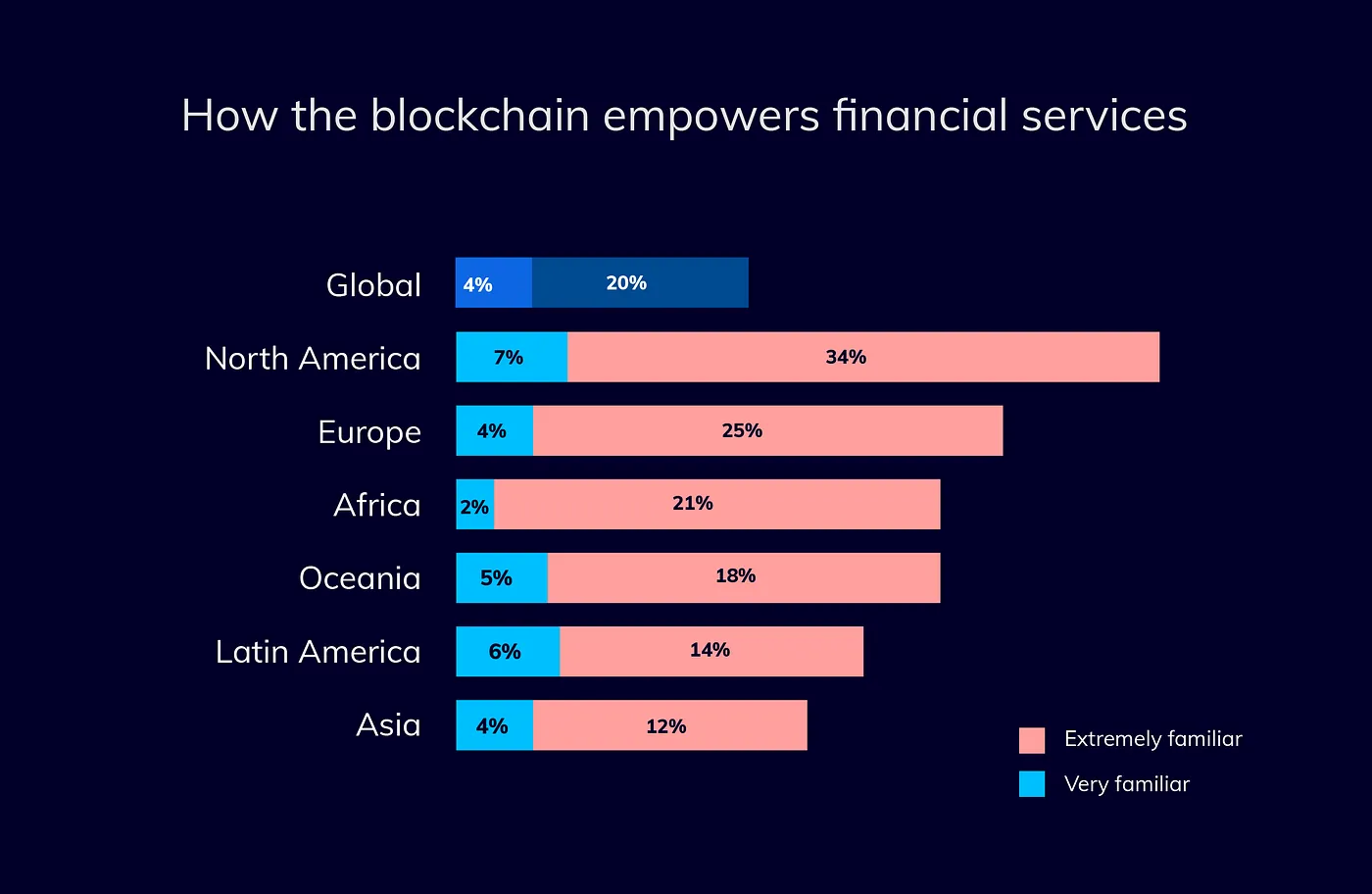

The survey is more than promising, as its results suggest that a startup can implement blockchain and expect the customers to know how to use it and why it is for the best.

Blockchain in Fintech — a struggle for competitors

All right, the Fintech industry is slowly adopting advanced technologies, including the blockchain. The pace of change, however, still allows outplaying the market opponents with a correct implementation of newer tech, combining Fintech and blockchain into one game-changing technology.

The blockchain offers a set of major improvements to the user experience, especially in Fintech. Its structure, work patterns and potential unlock multiple ways to start doing better than your regular competitor. The following list is as diverse as possible to cover as many issues and niches as possible.

- Decentralization can make a Fintech project shine;

- Blockchain can help boost Fintech security so users trust your product and everyone who uses it;

- Digital identity brought to Fintech by blockchain;

- Optimization through blockchain;

Decentralization can make a Fintech project shine

To kick things off, let's bust some significant myths about decentralization. It is not all about being independent of the government or another overseeing entity.

Decentralization is more about the rules that are set by the community (users, developers, entrepreneurs), than by someone that’s in charge. Consider this a form of online democracy, which offers much more transparency than the alternatives. Just like Wikipedia thrived over centralized competition years ago, the startups can benefit from the decentralization.

If you’re trying to attract open-minded people that are willing to create, build, start a business (if your startup is a platform, for example), the fact that the rules of the game are shaped by community and won’t shift overnight will make your project much more attractive. The DAO gave the power to the communities through crowdfunding. The more people contributed - the more important their vote was concerning the area to spend the funds. The rest is history, but these guys taught the whole industry a big lesson.

Blockchain can help boost Fintech security so users trust your product and everyone who uses it

A place where everyone is friendly, smiley and says hello to the neighbors each morning has that little smell of a utopia. But you don't have to go that far. Creating a means of secure and fast global payments will do just fine.

The blockchain is capable of storing all data about transactions and protecting it, eliminating the threat of post-factum cancellation and fraud. Smart contracts automate the deals and payments, acting as an independent, automated overseeing entity without ways to control it. The clients can benefit from the security due to every bit of information is recorded and protected, and every contract is enforced according to the clauses inside it.

The other tremendous benefit of Fintech blockchain is lower transaction fees and transaction time. Businesses and individual entrepreneurs often suffer from high sending fees, sometimes up to 16%.

Digital identity brought to Fintech by blockchain

The banking industry is losing 5% of its revenue each year to fraudulent activities. Lack of security, low awareness among the client base and other reasons force the financial sector to respond. More authentication, more verification, and double-checking.

The most advanced new profile checks (credit history, frauds, etc.) may take up to 50 days, and that is unforgiving to people who are conducting business and depend on a particular transaction to be made. These are KYC and AML protocols, to be precise.

Blockchain use cases in banking show us a way out of this one as well. The tech allows storing the history of each identity, its credit scores, and financial reputation and sharing the required data securely. The users with such digital "signature" can be trusted or distrusted instantly, based on their digital identity, and that's something that can be used to provide a high level of security from fraud while not delaying the business of people who are only new to the bank.

Digital identity makes life simpler for the clients as well due to a life free of constant reviews and screening procedures (those that are visible to the human eye). It also makes verification simple. Whether it is a log-in on the service or digital confirmation of transaction: blockchain can tell whether the activity is malicious or not and proceed according to that.

The race for trustworthiness and safety made banks miss out on billions of people that never, or occasionally used the services of the industry. Screening is an extensive process that may often deny people with lacking credit history the financial aid they need. They might have paid it back, they would have never gone rogue — but the banks still can't find enough proof to trust these people. And therefore miss $380 billion annually.

Blockchain allows more data to be analyzed and a more precise screening result eventually. This can help the Fintech industry include more clients in the industry and generate a bigger profit while providing better service.

Optimization through blockchain

Accenture predicts that banks will be able to save up to $30 billion by 2024 if they adopt blockchain. The growth tendencies suggest that the volume of transactions will increase and it will be much harder to track, approve, protect, and process for statistical information and other analytical data.

Blockchain can offer a solution to the issue of ever-increasing volumes of information like financial records, credit history, and more. The ledger system can bring decentralization into the industry and allow secure management and analysis of the information that will only get bigger. Proper management will cut operational costs, provide better forecast results, and allow to spot issues or areas that need improvement much faster. And current blockchain use cases in banking have already proved the predictions to be true.

The experts believe that traditional banking and, later, the traditional Fintech industry will lose to the rapidly growing blockchain-based Financial solutions market. We think that this may be the time to use the power of blockchain for financial services. Whether it be the Fintech security, asset management, identity verification, or anything else — this technology can give one an upper hand.

Wish to learn more about implementation of blockchain in the Fintech market? Let us know, and we'll help straight away!

_1758804763-small.webp)