The rapid spread of pandemics has made organizations of all sizes rethink their business strategies to ensure financial security in a newly-coined reality. From the shortage of qualified professionals, the world has shifted to millions of job losses just within a few months. The only industry that remained suffering from scarcity of talent was IT. Countries all over the world have become unable to fill tech vacancies: only 18% of countries didn’t report tech shortages. And that’s definitely not the end. According to the Bureau of Labor Statistics, the shortage of tech professionals is going to exceed 1,2 million by 2026 in the US solely. Therefore, companies were forced not just to streamline their operations but to prepare for the next disaster.

Global tech giants and evolving startups have changed the way they were managing their businesses. They’ve started looking from a different, more cost-effective, and less time-consuming perspective, they started outsourcing more. According to the GSA report, 70% of companies are planning to outsource more in the near future.

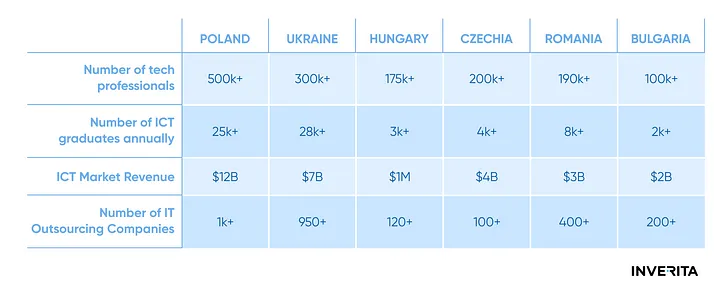

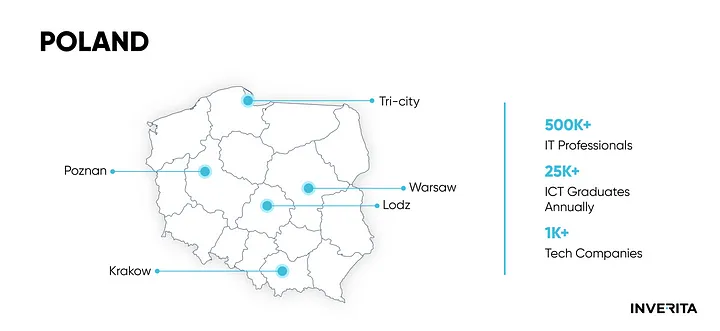

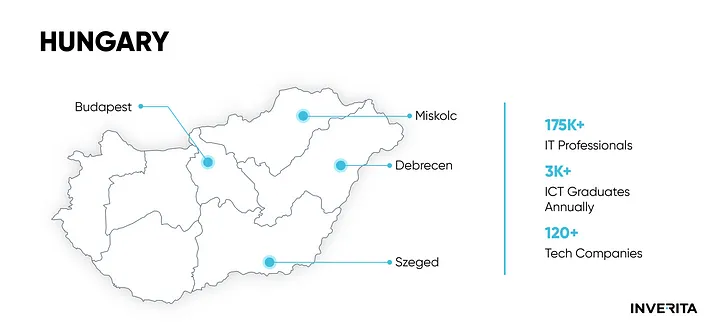

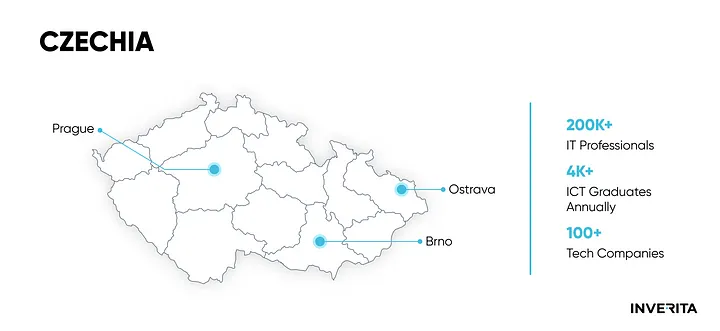

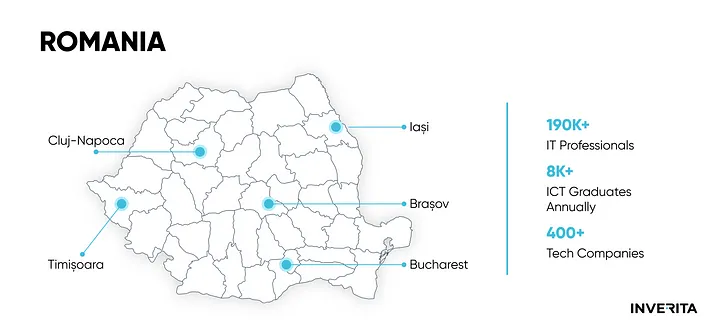

Eastern Europe software outsourcing has become one of the most popular options because of the availability of a vast talent pool, a big number of CS university graduates, geographical location, and a high level of technology adoption. A range of countries represents this IT region, being home to top software development companies in Europe that develop tech solutions for such behemoths as Microsoft, Google, Skype, Audi, Siemens, and many more.

Eastern Europe Software Development Costs

Eastern Europe software outsourcing pricing can’t be called very competitive when compared to their Asian rivals in China and the Philippines. However, outsourcing software development to Eastern Europe may still be an effective cost-cutting strategy for US and UK-based companies, as well as for businesses from Western Europe.

In the United States, you may expect to spend $75 to $175 per hour for small class projects, as per FullStack Labs. The hourly costs for mid-market class projects are already between $125 and $175. The circumstances are different in Eastern Europe, where the average hourly pay ranges from $30 to $70. To be more specific, the average cost in Ukraine is around $30-$60, in Poland $45-$69, in Hungary $44-$57, and in Czechia $39-$58.