#3 Financial Management and Funding Challenges

Many inspired but inexperienced founders don’t seriously consider the cost of starting the business. This lack of preparation often leads to cash flow issues, unforeseen expenses, and even insolvency.

The stakes are high because your ability to navigate these financial hurdles often determines your startup’s survival. Running out of money too soon is a common reason startups fail, and ironically, cutting corners in the early days can hurt your chances of building momentum when it’s needed most.

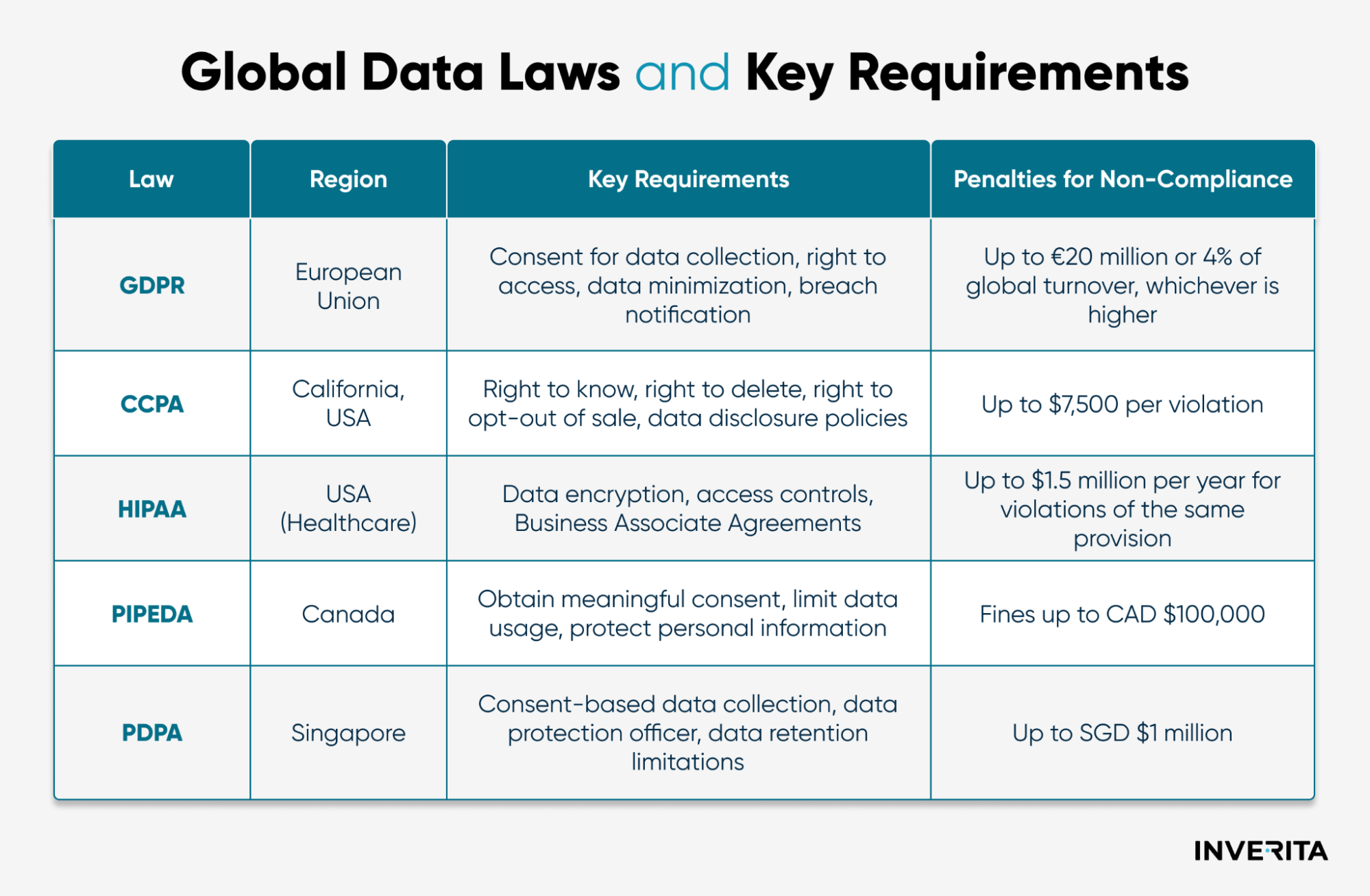

To top it off, staying compliant with regulations, like adopting anti-money laundering solutions, isn’t optional if you want to build trust with investors and stay on the right side of the law. A strong financial foundation is non-negotiable—your startup depends on it.

Solution: Financial Management and Securing Funding

Focus on essential expenses and avoid over-investing in non-critical areas, such as luxury office spaces or advanced tools you don’t need yet.

Use platforms like QuickBooks, Xero, or Wave to track expenses and cash flow in real-time. These tools can help you monitor your financial health and avoid surprises.

Allocate at least 10–20% of your budget as a contingency fund for unexpected costs. This safety net can make all the difference in a crisis.

- Keep Personal and Business Finances Separate

Open a dedicated business bank account to ensure clarity and prevent commingling funds, which can complicate tax reporting and investor scrutiny.

Research funding options that align with your startup stage. For example:

Pre-revenue stage: bootstrapping, friends and family loans, or crowdfunding.Growth stage: venture capital, angel investors, or revenue-based financing.

Tailor your pitch to the type of investor, focusing on their priorities (e.g., scalability, market fit). #4 In-House Team Only

In-house is nice, for sure. You’re working all in the same office, hopefully, united by your company culture and huge willingness to make it a successful business. What’s more, management has full control of the ongoing processes and any issue can be resolved at the reach of the hand.

Yes, but.

- If you’re hiring in a specific tech stack and domain, there might be a lack of candidates.

- Searching for the right candidate and recruitment can take up to a few months.

- If your company is located in the USA, UK, Canada, or other “tech-expensive" countries, it will be a big check.

- Add expenses for vacations, insurance, social packages, hardware, software, etc.

- Paying for downtime.

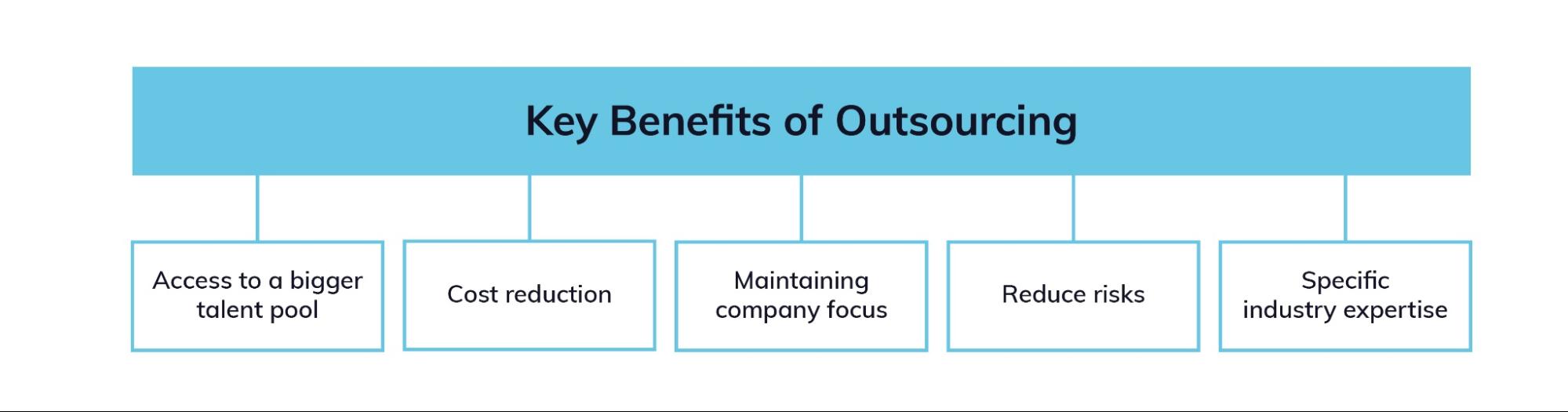

Solution: Startups can Outsource

Some time ago, hiring an outsourced team was considered a huge risk. Today, businesses are no longer limited by geographical borders, they can hire everywhere, saving costs, and time for recruitment, and most importantly, they get the best talent in the required niche.

Outsourcing is much cheaper than hiring an in-house team, not just because of savings on salaries but also on expenses like office space, equipment, insurance, and employee benefits.

Labor costs vary significantly by country. For example, the average annual salary for a .NET developer in the U.S. is about $98k, while in Ukraine, it’s around $36k, according to Indeed.

Besides cost-saving which is one of the biggest startup problems, outsourcing brings a lot of other benefits.