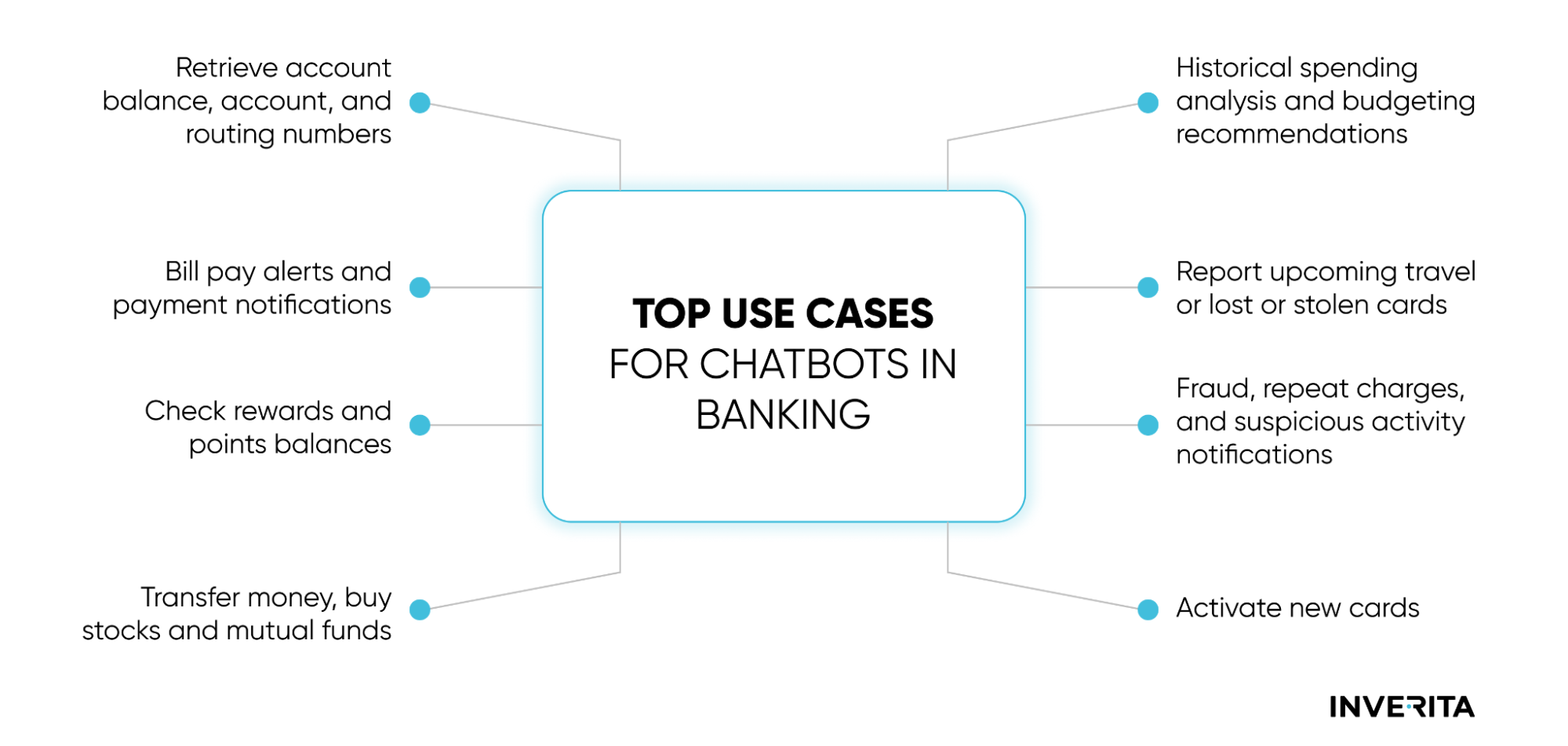

One of the most famous and most-accessed virtual banking assistants, Erica of Bank of America, has already helped more than 32 million customers with over 1 billion interactions. Erica leverages NLP and its predictive nature can anticipate why customers are reaching out. It also gives customers an ability to switch to a human assistant, letting the agent use information previously collected by Erica. which leads to even more personalized experience.

#3 Peer-to-Peer Mobile Payments

P2P systems facilitate money transfers between individuals by making them fast, convenient, and secure. The technology allows transferring funds directly from one person’s banking or checking account, credit or debit card, or app to another person within minutes.

Some time ago, banks fell short of instant payments. Users had to wait for a few days to transfer money and therefore frequently opted for P2P platforms such as Venmo, CashApp, and Zelle. Today, integration with such platforms is one of the most popular features of mobile banking that makes it easier than ever for individuals to send and receive money without having to use traditional payment methods.

For example, the Chase mobile app and Ally mobile banking allow their customers to send and receive money with Zelle, a popular P2P payment service while Capital One mobile offers P2P payments through its own payment service called "Capital One P2P Payments."

#4 Personal Financial Assistants

Modern banking apps are not just about making payments. With recent innovations in fintech, they have turned into a sort of personal financial assistant always available in users’ pockets.

Financial obligations that people regularly have to make now are delegated to mobile banking apps. For example, users can allow automatic payments for recurring bills such as electricity, water, loans, etc. They can monitor their credit score and report, receiving an alert about changes and personalized advice for improving credit.

Apps also show detailed information and analyze monthly income and spending, helping users to track their funds and better manage their monthly budgets and can even send notifications when a user exceeds their budget or personalized suggestions for reducing expenses.

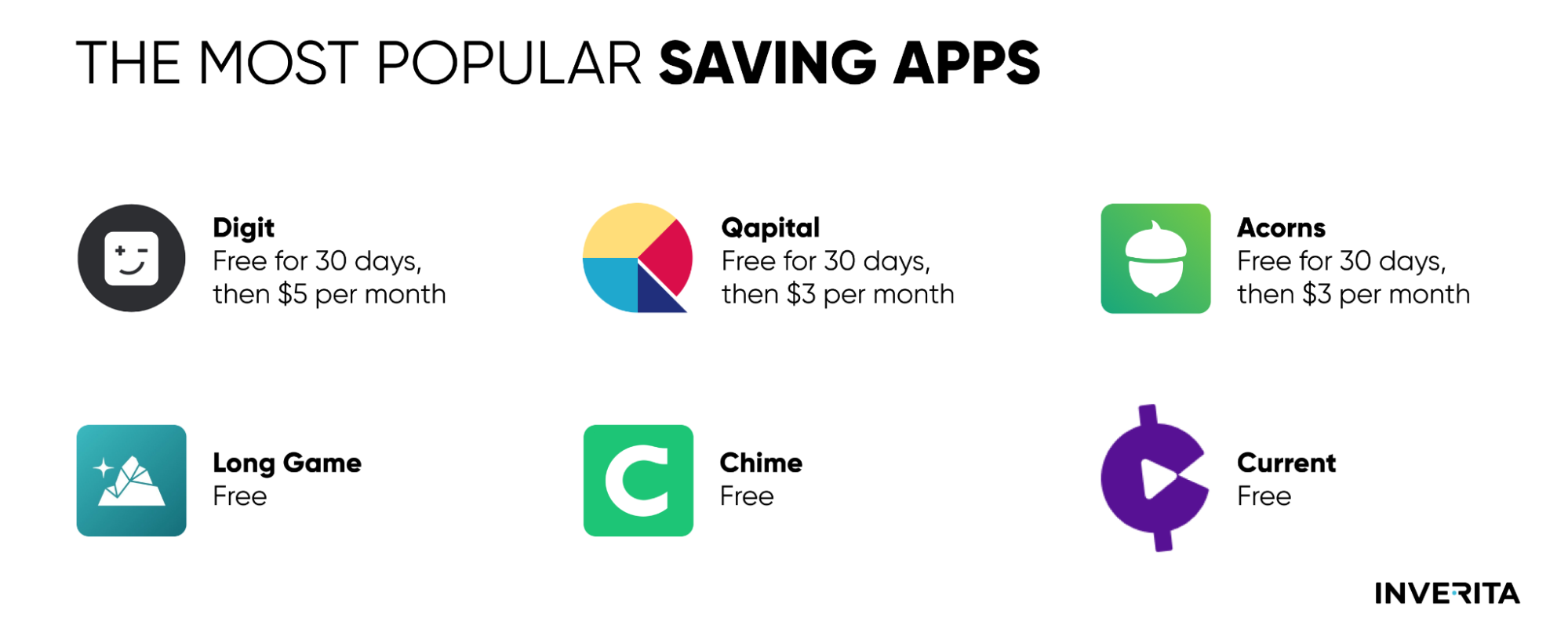

#5 Automated Saving Tools

Many households in the US cannot absorb even small financial shocks. According to the Federal Reserve Board, 4 in 10 cannot come up with $400 for an unexpected expense.

Therefore, some banks already offer new mobile banking features to help their customers to save up or allow integration with popular saving apps. Such tools automatically move money into saving accounts at regular time or spending intervals. An application estimates how much money a user can afford to save and moves it into a separate savings account. Usually, it rounds up the purchases to the nearest dollar and automatically puts the change into a savings account.