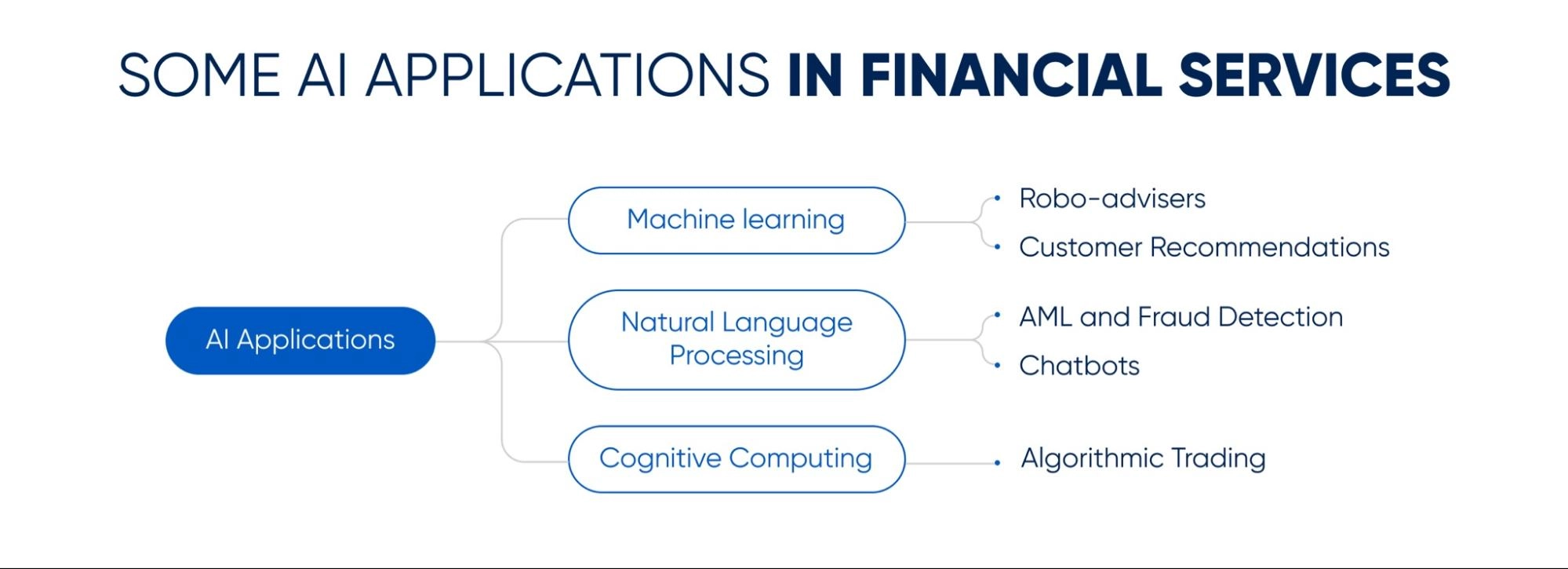

Meet Cleo and Erica - top financial assistants who never sleep. Erica is a thoughtful Bank of America representative who gives information about transaction history, cash flow, and actually about anything connected with your bank account in a polite and professional way.

Cleo, on the contrary, is a friendly advisor who can prevent you from going on a spending spree with $100 in your bank account. They are not just regular assistants who can help a limited number of people a day. They can process hundreds and thousands of requests day in and day out. They are robots. Financial institutions and banks all over the world are deploying these kinds of new financial technology trends to meet the future that is impending with great speed.

Not to become an outsider in an “innovation marathon”, companies are actively investing in financial software development services, pushing the boundaries of the industry more every year.

In today’s blog, we’ll discuss top financial technology trends which are a Holy Grail of successful BFS companies.

TOP 10 Biggest Fintech Trends 2026

Trend 1: Internet of Things

A special place among fintech trends has been taken by a giant system of the Internet of Things. According to the analytics, the IoT market has experienced rapid unexpected growth, reaching $290 billion in 2024, and is foreseen to grow to $1.6 trillion by 2030.

Such rising popularity is driven by the ability of IoT devices to collect and analyze massive amounts of customer data. Through processing this data, banks and financial institutions can reduce NPAs, prevent fraud, increase operational efficiency, and completely redefine the customer experience.

IoT could offer banks up-to-date information about the projects or persons in whom they are investing, allowing them to precisely calculate the return on investment. Mobile banking software now syncs with credit and debit cards, allowing users to make wireless payments using only their phones, with the goal of making transactions as simple as possible. The function has been extremely useful during the COVID-19 epidemic in stores and other busy areas.

Mastercard has used the technology to build strategic partnerships with market-leading companies such as General Motors, Samsung, and Coin. The purpose of these partnerships lies in the willingness to streamline some everyday activities. For instance, Samsung’s smart refrigerators have an in-built functionality through which you can order groceries. Customers can shop and select needed items, add them to the cart, and then have them approved by a 4-digit PIN and paid for in a single checkout experience. The groceries are delivered to the customer’s home directly by the store, completely redefining the grocery shopping experience. How do you like this fintech trend?