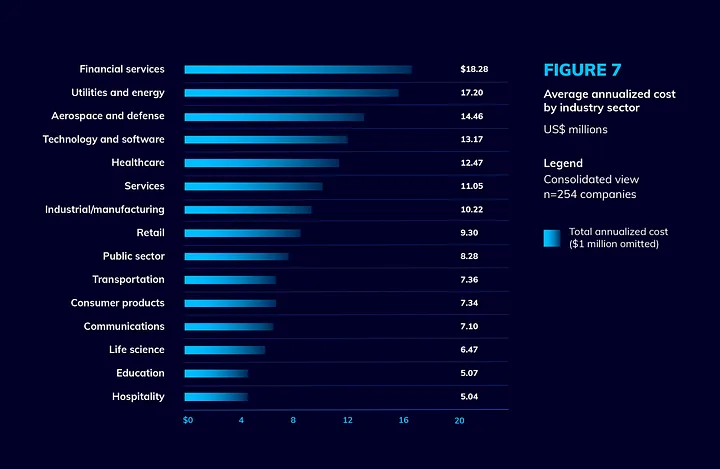

The damage dealt with other industries by cybercriminals is equally staggering, meaning that a cybersecurity expert can easily expect to find a job in any of the spheres mentioned above.

Blockchain and Distributed Ledgers as the New Trend for Financial Services

Probably the talk of the decade, blockchain is discussed by countless experts, yet much fewer can make it work for a particular environment.

Businesses are constantly seeking individuals who can assist them in leveraging blockchain technology to save billions of dollars in avoidable expenditures. And that's what makes this such an appealing profession.

The use of blockchains allows contracts and agreements to be executed without the participation of attorneys or bureaucratic red tape, assuring the security of investments through the use of smart contracts to efficiently manage risks. Moreover, utilizing blockchain technology, copyrights can be readily verified, and blockchain technology may be utilized in a wide range of applications, from trade to electoral voting.

Due to blockchain technology, companies can eliminate third-party participation in financial transactions. One may keep and move funds without the assistance of a bank since, as previously said, blockchain systems have effectively incorporated the power to check identities, record transactions, and execute contracts.

Inventory and asset management, transportation and logistics process management, trading, tracing the origins of items and materials, supplier identification optimization, signing procurement contracts, and auditing and tracking activities are all possible with decentralized systems.

As a side benefit, this technology is employed not just in banking and financial services, but also in a number of other businesses, making life easier and more pleasant for customers. Consequently, a financial professional's ability to understand the foundations of blockchains is just as important.

An expert with blockchain knowledge will be asked to build platforms for money transfer (both crypto and fiat), smart contracts, advanced data management, and so forth. Across the United States, a skilled blockchain developer can secure a deal that pays range from $124,500 to $203,000, with the highest earners averaging $231,500 each year.

Data Science as an Integral Part of the Industry

Data science is among the most important differentiators for every fintech firm. Data Scientists can employ data models on a regular basis to examine historical and current data and forecast future patterns in order to apply what they've learned to credit risk scoring, fraud detection and prevention, portfolio optimization and asset management, and client retention. An analyst's responsibilities include using SQL, Python, and other computer languages, as well as creating dashboards and automating procedures. However, these are only tools for attaining two goals:

- Produce more fact-based and statistically-based decisions (as opposed to opinion, intuition, and experience).

- Search for ways for the product and the company to grow together.

The fintech analytics service includes solutions to both asked and unasked questions, the creation of conceptual theories and approaches, and recommendations based on those models and frameworks, all of which contribute to enhanced corporate performance.

Dealing with data is the ideal strategy in most cases, although this isn't always the case. Decisions that lead to product and business actions are aided by analytics. In certain cases, you may be able to make a decision without looking at the data by simply formalizing all possible situations and options and then removing the majority based on what the team already knows. It has nothing to do with programming for the industry. As a data analyst, you must be able to read documentation quickly, learn and use data manipulation tools quickly, and automate your routine.

Jobs in Fintech Startups

The number of Fintech startups is growing so the demand for Fintech professionals. Startups make it easier for those having Fintech certification to get their dream job.

Soft Skills Get More Value for Most IT Jobs

While there's a substantial list of what you can do to succeed in financial technology jobs, the nature of the industry demands that you have your soft skills well-developed. Fintech originated from the spirit of innovation and versatility, brought to the business by startups, and the soft skills of the employees are given huge importance on a daily basis. Here are some that one would most likely encounter in most of the Fintech careers ads:

- Openness. As a manager, you have to be as open with other employees as possible. As a developer or engineer, the same thing is always preferable. An open person can communicate better, seek assistance faster, and thus deal with problems far more efficiently than a guy who likes to do everything by himself.

- Problem-solving. An employee solves a ton of issues on a daily basis, one may say. This concept, however, circulates the mentality. An employee must be proactive and seek opportunities to improve on existing results. Quick thinking is a crucial part of problem-solving, as it allows no time for hesitation or panic — only determination and cold analysis of the destination.

- Communication. A derivative of openness. It means how well the person integrates with the team both on and off the actual working process. Communication allows more efficient collaboration of the departments and teams, thus granting bigger benefits in the end. It is imperative to build strong bonds within the team, so each employee is ready to take on any challenge for themselves and for "that guy next to them."

- Transparency throughout the organization. A concept that applies more towards managerial staff. The age of startups made traditional management obsolete. Nobody will appreciate secrecy, or worse treatment just based on position. Today's mentality is about CEOs being equal to junior developers on a human level. When managers are openly discussing casual stuff or project details with everyone else despite their position, it creates a bond within the team that is highly beneficial for the company.

- Adaptability. The atmosphere and workflow of a Fintech startup inevitably mean issues that one will need to tackle regardless of their skill or position. Versatility and the ability to adapt are critical for an employee to move further up the career ladder within startups or other highly digital environments.

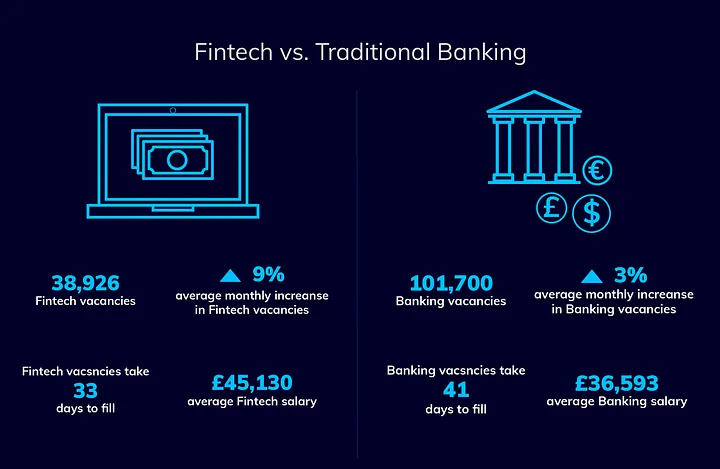

Fintech Salary

Fintech salaries are rising due to the demand for Fintech jobs that is constantly growing. Indeed research shows that the most high-paying jobs in the Fintech industry embrace management roles, project owners, software engineers and architects, sales, and obviously C-suite.

Summing Up

All in all, why should you strive to work in financial technology? The truth is that financial institutions, investment banks, and other Fintech companies are in a hunt for professionals who are highly skilled and valued. In our modern world, it’s just crucial to be an expert in a peculiar, narrow field. If you want to get a job in Fintech, master both the hard and soft skills we’ve talked about in this blog, and go ahead!

If you are on another side — not looking for a job, but looking for someone to work for your startup — contact inVerita. We have component professionals who can help you with the technological challenges you face right now.