Modern fintech solutions have emerged as a response to the pressing demand for more convenient and personalized banking services. These innovative apps left traditional banks behind, enabling numerous financial operations via phone.

They provide unprecedented personalization in digital banking that goes beyond just addressing clients by their names – they tailor services to each customer individually and make offers based on unique preferences, financial goals, spending habits, and risk tolerance. Fintech solutions are reshaping the industry and leading its future as they do exactly what people want – resonate on a deeper level.

Numerous surveys suggest that people choose banks that offer personalized customer experiences at every touchpoint; they are willing to share their data to get individual offers, provided robust privacy and security measures are ensured.

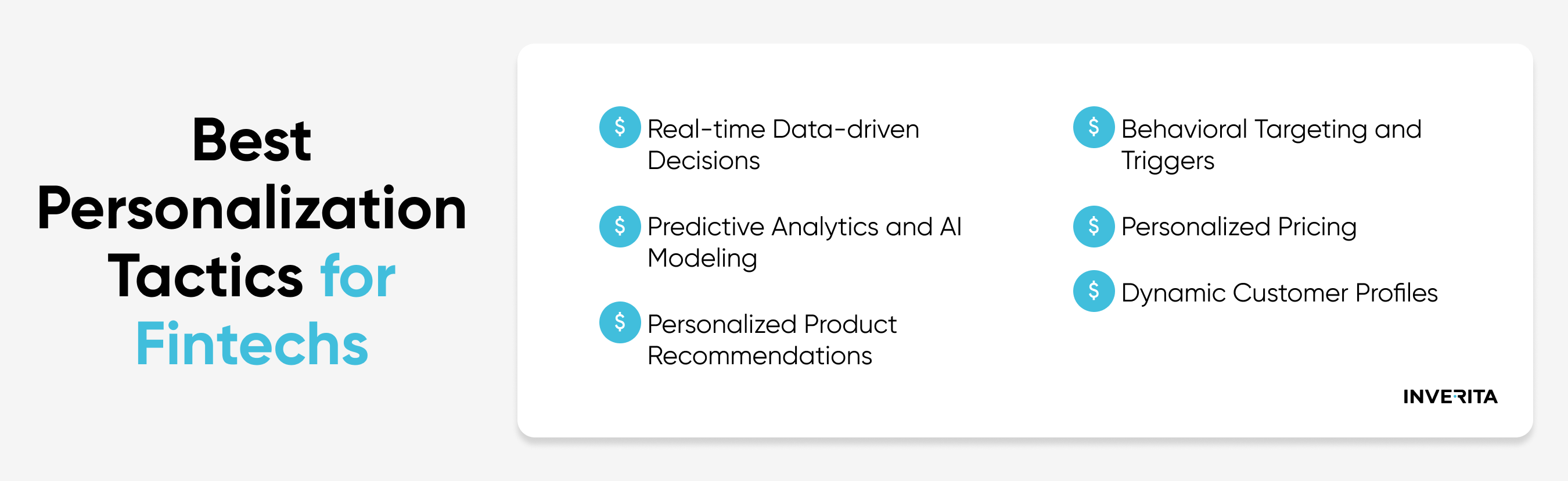

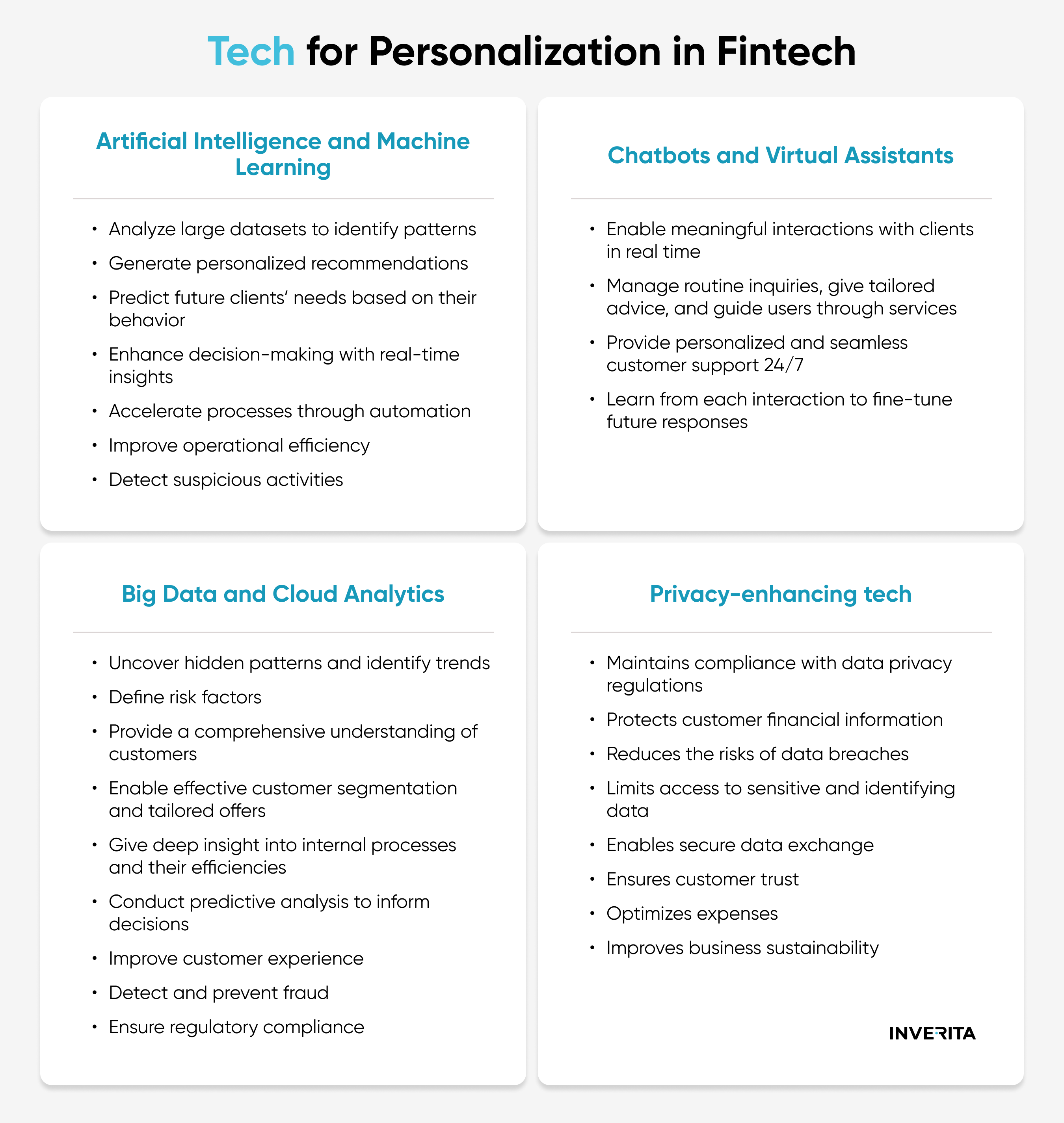

In this article, we uncover the most effective digital personalization tactics for fintech, share tips for seamless implementation, explore common challenges, and review the top technologies driving personalized digital banking in 2026.

Why Digital Personalization Matters in 2026

Technology has once brought personalization to different fields, quickly increasing consumers’ expectations. The one-size-fits-all approach and generic services no longer work – now, people expect a deep understanding of their needs, preferences, and pain points wherever they come. And the requirements in the financial landscape are relatively high when it comes to personalization.

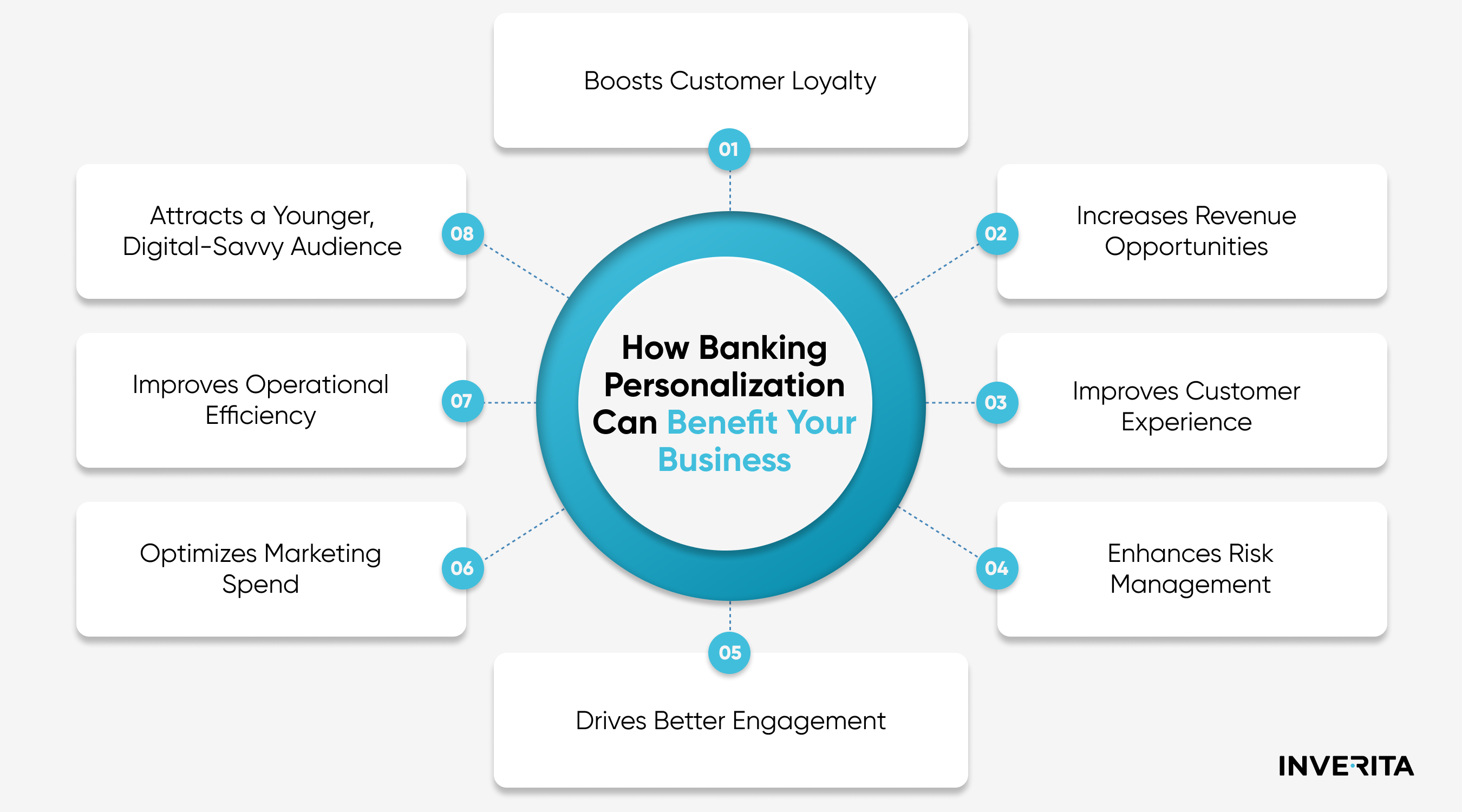

Personalised banking services increase customer satisfaction, build trust, and foster loyalty. When people feel valued, they are more likely to engage and stay. This, in turn, increases revenue, solidifies credibility, and drives business growth at scale.

Relying on top-tier technologies, fintech solutions bring new standards to the industry with services tailored to fit each customer uniquely. Some apps reached a higher level of personalization – they serve as a personal financial advisor that users can have at their fingertips. For example, Monzo and Revoult analyze users’ spending patterns to suggest actionable insights and tips on how to achieve their financial goals. Powered by advanced technologies, these and many more similar apps make financial management straightforward for everyone.

Examples of Successful Personalization in Fintech

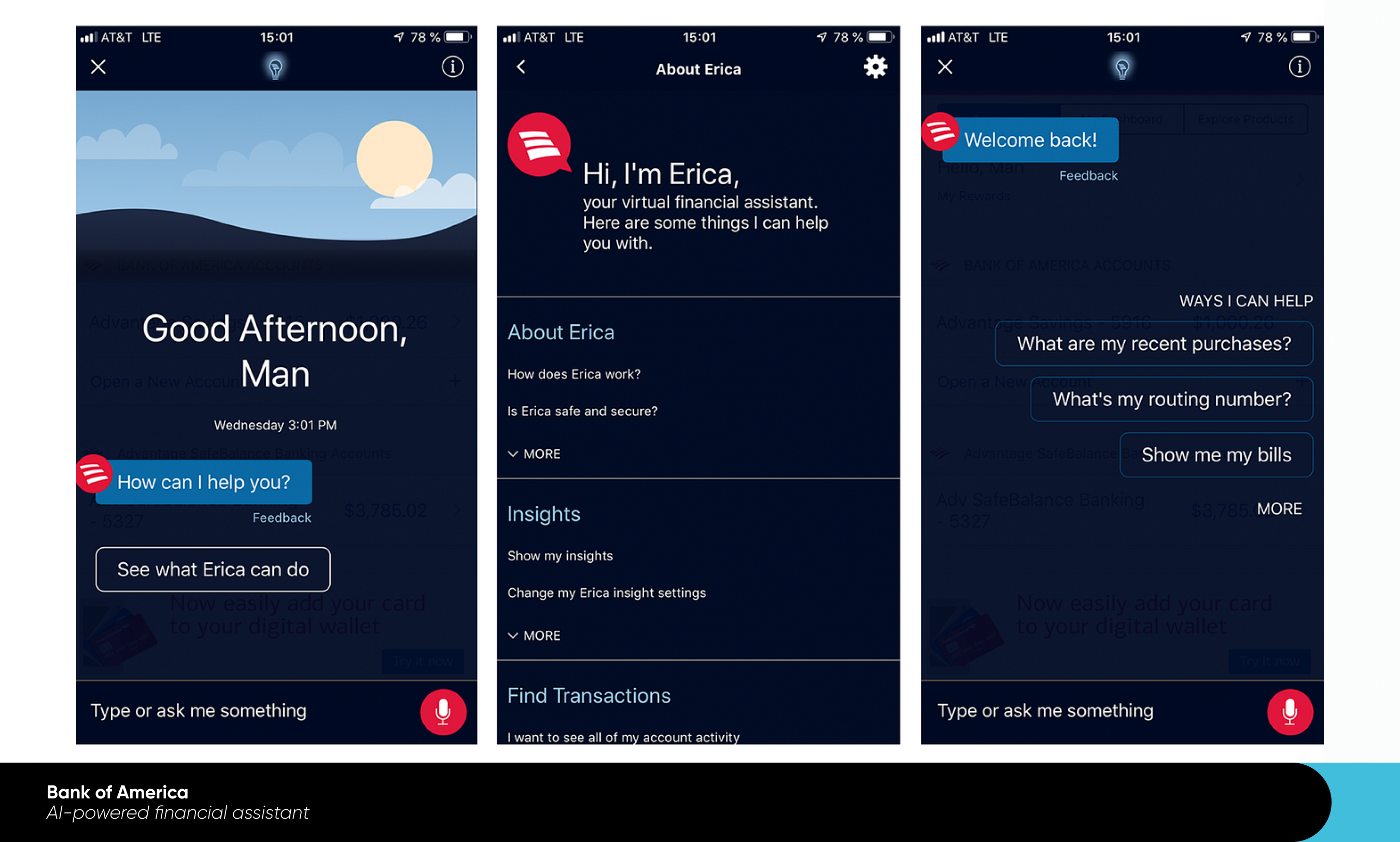

Bank of America – AI-Powered Financial Assistant

Bank of America introduced its virtual assistant, Erica, which relies on advanced data analytics and AI to provide customers with personalized financial advice, timely reminders, and spending insights based on individual behavior.