-

User Authentication and Security

Security is the main priority in Fintech apps, as they manage the most sensitive customer’s data. Integrate two-factor authentication with voice, face, and fingerprint recognition for sign-in. Make sure the app displays only the three last digits of a card number and restrict failed login attempts.

Notifications and a pleasant user experience go hand in hand when we’re talking about apps. People like staying informed about special offers, and new features of the app, and they like having a personalized user experience. In turn, notifications bring a lot of advantages for your business: they increase conversion rates, help to retain users, and track actionable metrics.

Instead of time-consuming entering the numbers, give the users the ability to scan them. This is a much more convenient and error-free way to handle money operations. In 2015, Wintrust and FIS set up ATMs where their customers can just scan the QR with the help of their app to withdraw money. They estimated that such a withdrawal takes 8 seconds in comparison with 47 seconds of regular withdrawal.

Chatbots boost the interaction with your customers. They can take over a significant part of the human load in chats, giving users immediate answers to their questions. That way, users don’t overload the company’s contact centers with calls and emails about minor difficulties they face. They can receive their answer straight away 24/7.

Establishing a connection with other applications to exchange data can significantly increase revenue and give advanced functionality to your product. With the help of API integration users can access their checking account information, check where the nearest ATM is, or make an online buy with PayPal, for instance.

Efficient account management lies at the heart of every reliable Fintech app. From checking balances to viewing transaction histories and managing multiple accounts, this feature provides users with a comprehensive overview of their finances.

In 2020, digital payments surpassed cash transactions for the first time, showcasing the growing influence of payment features in Fintech applications. This feature enables instant peer-to-peer payments, simplifies bill splitting, and facilitates international transfers with reduced fees and processing times.

-

Budgeting and Expense Tracking

Empowering users to control their finances, budgeting, and expense tracking features offer insights that drive smart financial decisions. As per a survey, 75% of consumers find budgeting apps effective in managing their money, underlining the crucial role these features play in Fintech apps.

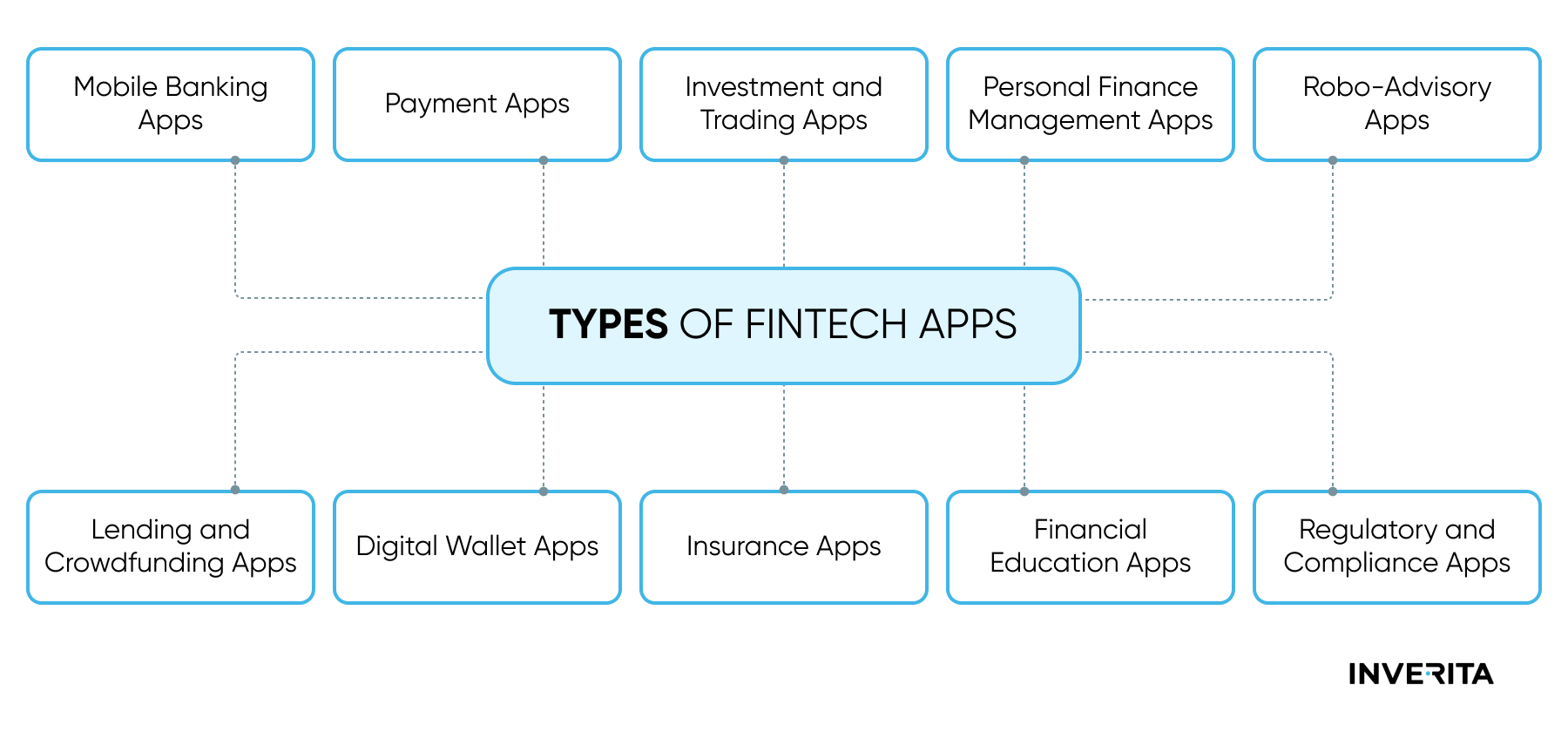

Fintech apps have democratized investment opportunities, allowing users to invest in stocks, ETFs, and cryptocurrencies effortlessly. Robo-advisors, such as Wealthfront and Betterment, create tailored investment portfolios based on user preferences and risk tolerance. Micro-investing platforms like Acorns encourage users to invest spare change, making investing accessible to individuals with limited capital.

Fintech lending platforms simplify the borrowing process, making it easier for individuals and businesses to access credit. Micro-lending apps connect lenders with borrowers on a smaller scale, fostering financial inclusivity. These platforms provide quick, convenient, and often more affordable borrowing options, revolutionizing the lending landscape.

Educational features within Fintech apps aim to enhance users' financial literacy. They offer articles, tutorials, and tools to help users understand various financial concepts, from credit scores to investment strategies. By promoting financial education, these apps empower users to make informed decisions, leading to better financial outcomes.

Fintech apps offer in-app chats, emails, and helplines to address user queries promptly. Accessible and responsive customer support ensures users have a positive experience, promoting trust and long-term engagement. By providing excellent customer service, Fintech apps build lasting relationships with their users, fostering brand loyalty.

Credit score monitoring features enable users to track their credit health over time. These tools offer insights into factors affecting credit scores, helping users make decisions that positively impact their financial standing. By regularly monitoring their credit scores, users can identify areas for improvement, leading to better financial planning and responsible financial behavior.

-

Integration with IoT Devices

Fintech apps are integrating with IoT devices, making financial management seamless and convenient. Connected devices, such as contactless cards and smart wearables, enable secure payments with a simple tap. Integration with IoT devices enhances user experience, offering innovative and effortless ways to manage finances.

-

Cryptocurrency Integration

Cryptocurrency integration in Fintech apps allows users to engage in the digital economy. These features enable buying, selling, and storing cryptocurrencies directly within the app interface. By offering easy access to cryptocurrencies like Bitcoin and Ethereum, Fintech apps empower users to diversify their investment portfolios and participate in the evolving world of digital assets. Cryptocurrency integration reflects the app's forward-thinking approach and caters to users interested in exploring innovative financial instruments.

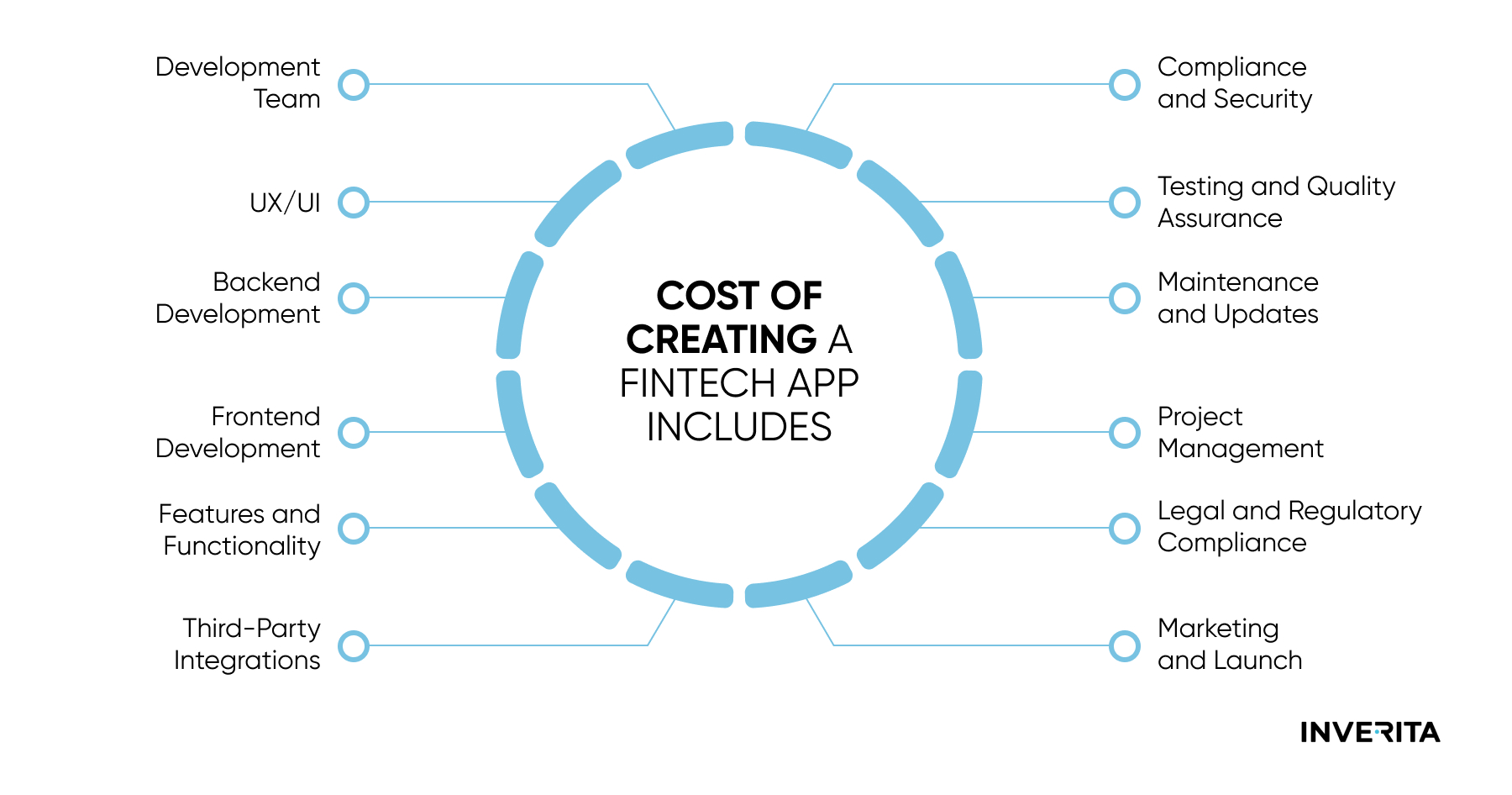

Cost of Creating a Fintech App

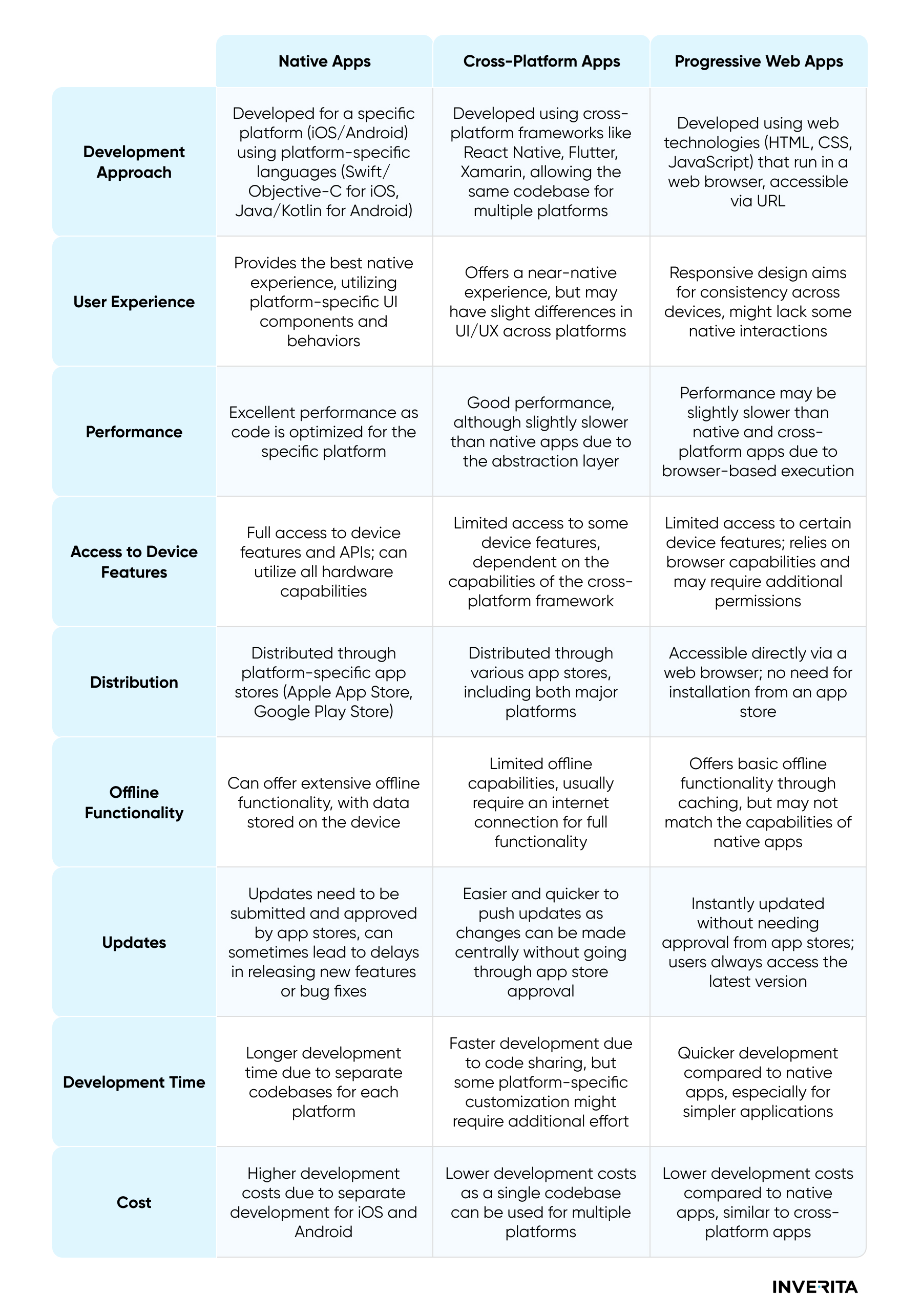

The cost of building a fintech app can vary widely based on several factors, including the app's complexity, features, design, development hours, choice of platforms (iOS, Android, or both), geographical location of the development team, and additional services like backend infrastructure, security features, and ongoing maintenance.

For a basic fintech app with essential features, the cost might start from $50,000 to $100,000.

However, you can significantly optimize the cost of Fintech development by outsourcing to developers in cost-effective regions, for example, Eastern Europe.