The Fintech industry is known to use artificial intelligence for a wide range of purposes. Digital enterprises use it for efficient chatbot response systems. Some businesses offer AI as an assistant for asset management and market analysis. The use cases of AI are widespread among the industry, and we can safely assume that technology will be further used. According to Mordor Intelligence, the AI market in Fintech is projected to grow beyond $7 billion from only $1.2 bln in 2017.

We have reached the point where standalone branches of artificial intelligence, especially artificial intelligence in banking, are making their impact on the industries, providing solutions to the issues that were previously operated by human employees or unattended to at all.

Machine learning emerges as a branch of AI that allows utilizing the power of said intelligence for deeper, contextual purposes. A few years back, the companies were forced to do everything with the help of human analysts, model builders, and other highly-skilled and experienced staff.

Today the ML is capable of assisting in the analysis of the market patterns, taking into account previous cases and building a successful analytical model with little to no intervention from humans.

Fintech companies are already reaping the benefits of machine learning, yet we believe, that the industry will evolve further. It usually results in breakthrough solutions as well as a significant improvement of the existing ones (we'll cover both further down the article).

We will try to elaborate on machine learning as a soon-to-become integral part of the whole system. Let’s delve into the matter of ML within fintech software development and machine learning projects in the finance industry.

Machine learning in Fintech: benefits

Machine learning applications in Finance have vast potential in optimization, analysis, and customization. Machine learning becomes a powerful tool for data-based solutions.

Here's a quick preview of 5 significant advantages of ML in Fintech:

- Unique customer experience

- Marketing opportunities

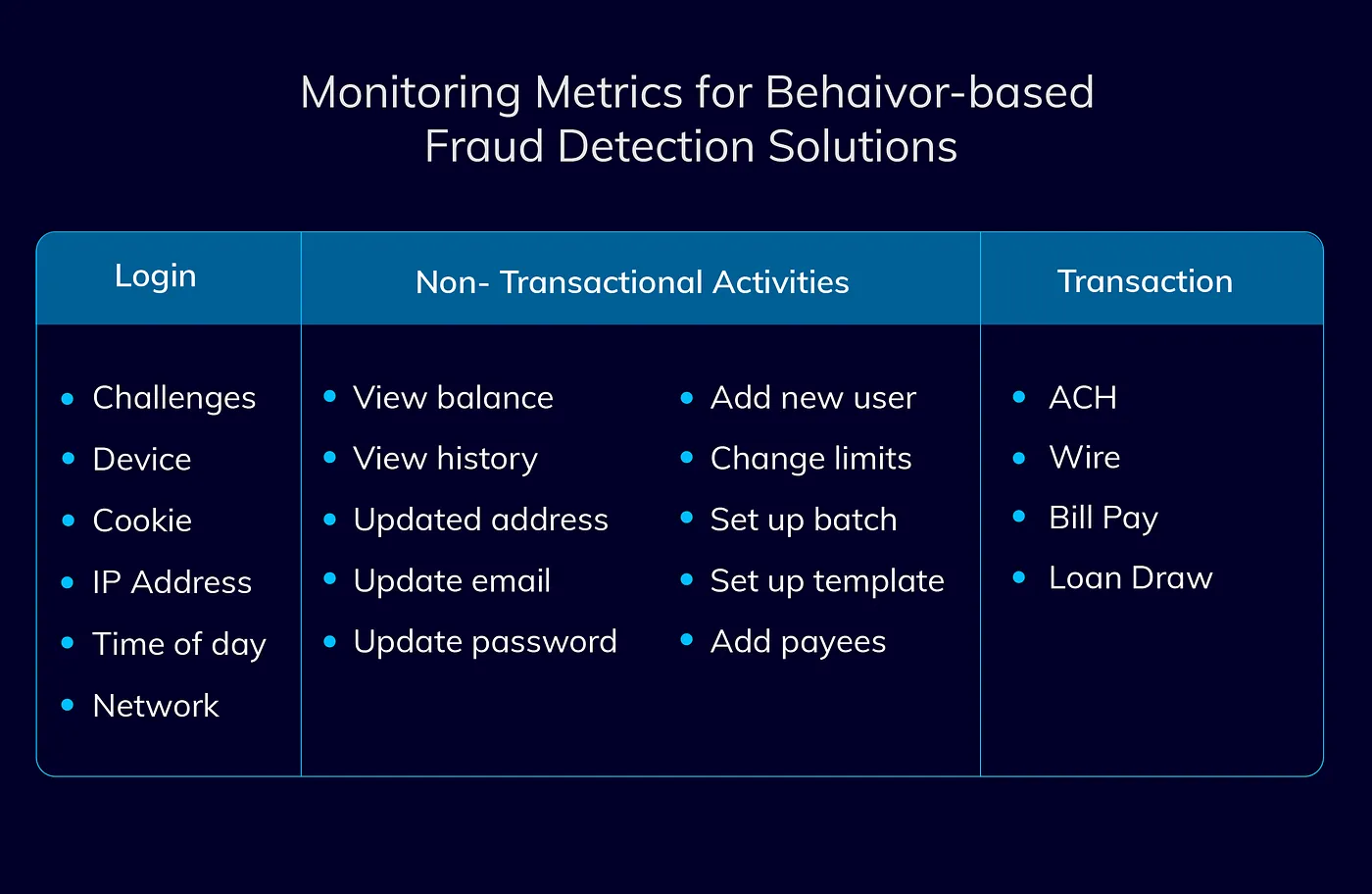

- Fraud detection

- Stock market forecasting

- Custom solutions based on machine learning

Let’s savor all the details and see why exactly this tech is helping financial services live the dream life.

Machine learning for financial services: unique customer experience for Fintech clients

No matter how complex the formulae are, how extravagant the analysis is, or how advanced mobile banking technologies used — the customer still needs to navigate it and use everything properly.

The business (regardless of the industry) will perform better if the client feels valued. And that value is brought by a unique experience. Starting as a set of commands and pre-written responses, AI and machine learning, in particular, transformed the support chatbots into full-scale robotic assistants.

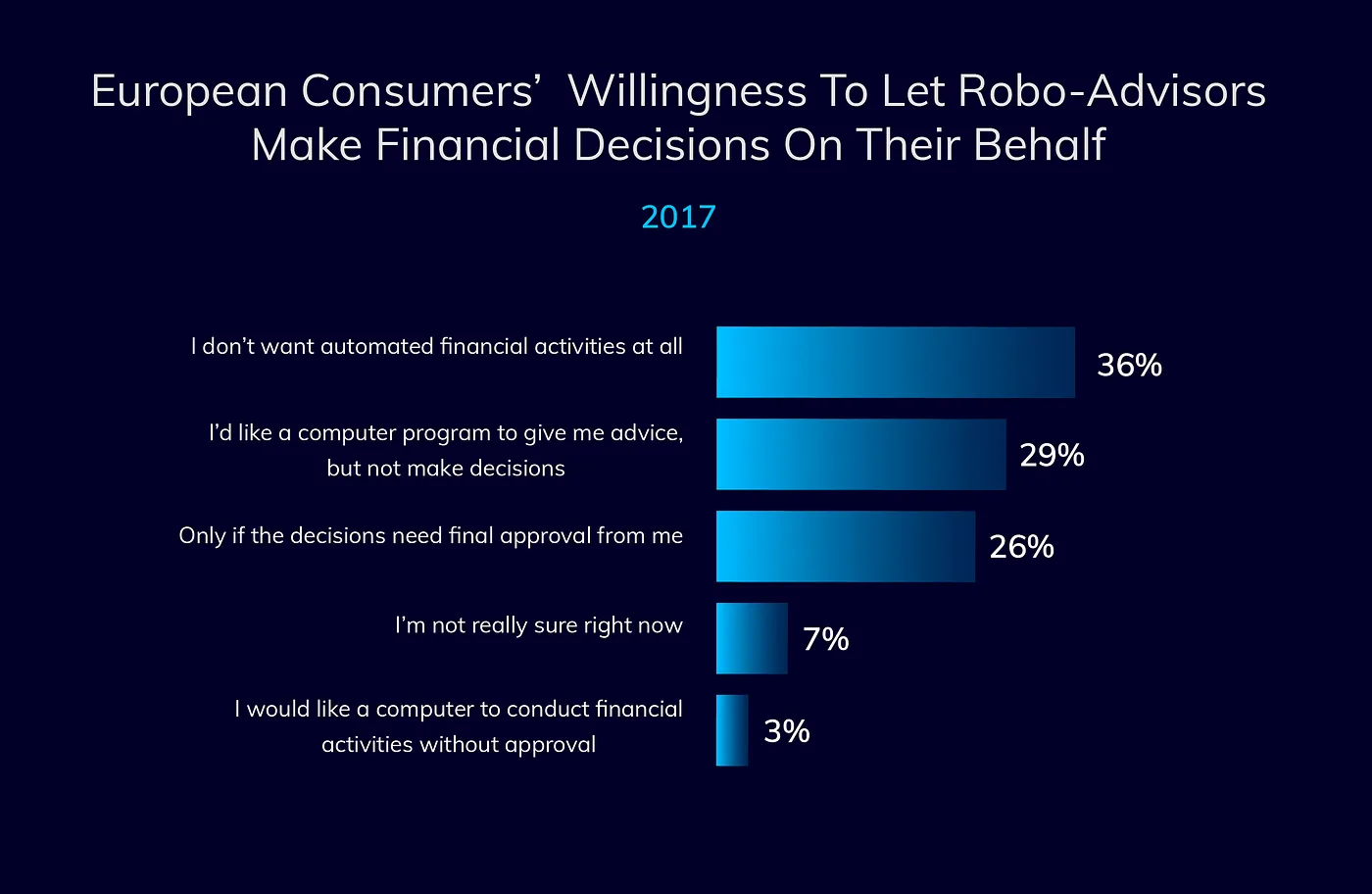

The general public is still unsure about fully-automated financial processes, but more and more people are ready to take advice from a non-human assistant, as BI Intelligence report suggests: