How APIs Benefit Fintechs

Usage of APIs brings multiple benefits for fintech organizations and financial institutions. They help to customize customers’ experiences, increase cost-effectiveness, increase revenue, and much more. Below we listed some of the most prominent benefits of API integration.

APIs Increase Cost-Effectiveness

The wide range of services that a bank can provide is quite expensive. Through API interfaces banks are able to customize the clients' experience and thus provide a broad spectrum of services while reducing resources and making their clients more satisfied in the long run. Banking consumers may tailor their co-operations to their own demands rather than staying trapped with a dull, distorted platform. Integration of bank accounts by software, for instance, empowers clients to handle and contrive their bankings in one location.

APIs Have Opened Up Fintech

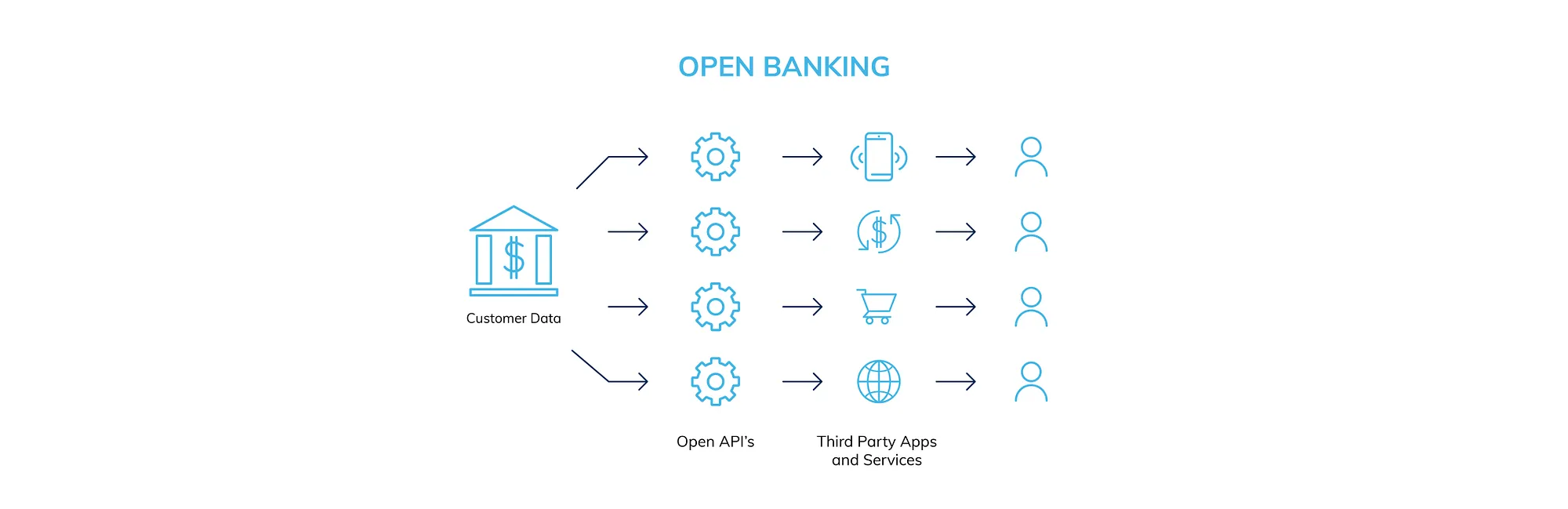

In 2016, the Second Payment Services Directive (PSD2) laid the foundation for the further development of a more integrated EU internal market for electronic payments. Before this directive came into force, banks had the right to keep all information about their clients confidential. Security and privacy meant well, but not so easy for programs that want to take advantage of the data. With PSD2, banks are essentially obligated to give information to third parties.

This does not mean that users have no control over their data, on the contrary PSD2 gives them even more power to govern what they do with it. So for example, if a person wants to share his current account information with a budgeting application, the bank has to allow this. This demonstrates that the implementation of PSD2 has opened up the possibilities of fintech, allowing consumers to have far more opportunities to enjoy different offers and programs.

APIs Have Future-Proofed Fintech

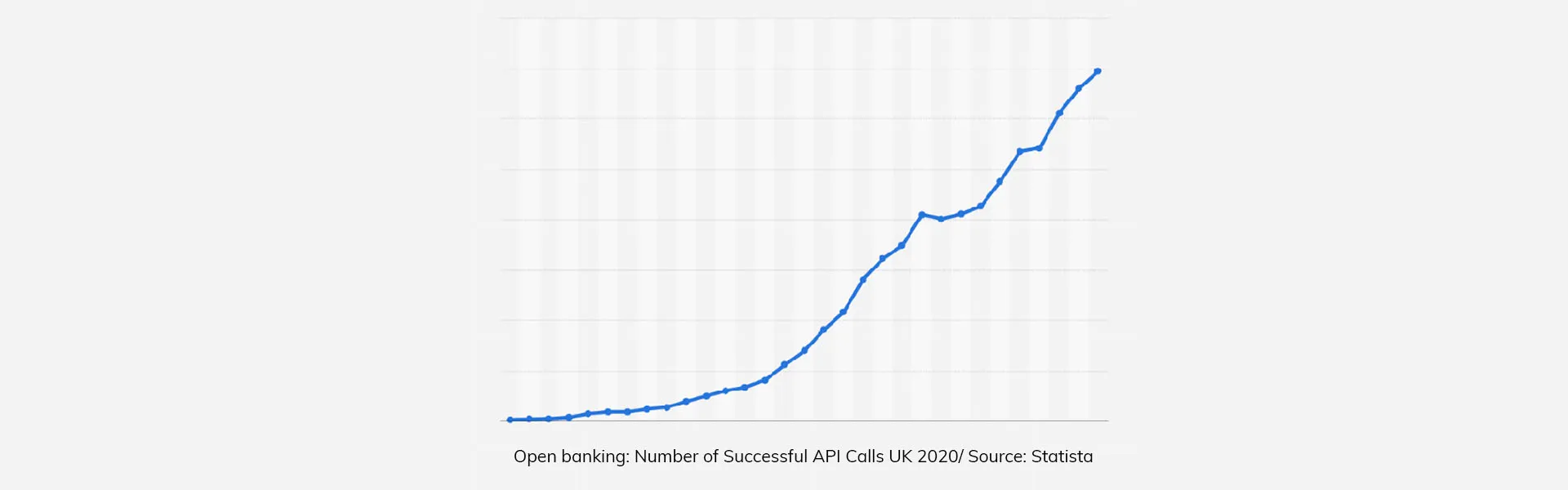

APIs usage in fintech keeps on shaping an industry's financial services hereafter. As the G2 study states, API for fintech traffic growth reached 133% between the end of 2019 and mid-2020. The ongoing rise and further evolution prove that financial technology is not only getting stronger in numbers but is also becoming even more robust. It is expected that this trend should increase and evolve in the coming years.

How Fintechs Are Using APIs

Numerous global Digital giants' present success may be due to strong key orientation on IT services mostly as a set of interconnected as well as reusable construction blocks. These organizations expand their business and innovation ecosystems through presenting applications and services for third parties to integrate into systems for their customers. APIs are the structural elements that facilitate this modular microservice-based model, moreover, their acceptance is visible in the financial industry's fast transition. API for fintech occurs in the most diverse fields, hereafter we will review some of them.

Payment Processing

With the application programming interface, it is possible to dramatically expand payment methods and make the ordering and payment process for online purchases incredibly smooth.

By getting rid of the barriers between the consumer, the commercial website, and the bank, API use in fintech provides a very seamless way to shop around the world and send funds through online platforms. Online payment APIs transpire quite a hot topic among developers and entrepreneurs because they offer a consistent patron expertise by permitting users to make purchases externally ever moving a company's website. Venmo, PayPal, Stripe, and Square are already revolutionizing how people purchase.

Peer-to-Peer Programs

Previously, peer-to-peer (P2P) programs allowed people to upload content from other people, and were related to software. Now a new kind of P2P utilization involves APIs. This makes foreign exchange a lot easier, lowering costs for all participants, as well as loan programs that allow investors to lend money. APIs for lending programs enhance the loan-making procedure.

Investment Management

Another manifestation of API use in fintech is the management of the investment. Investment superintendence APIs present financial specialists and agents access to the personal case report, removing the need for them to assume or piece together a map regarding their client's assets and exclusive merit of many origins.

White Labeling

White-label APIs are available for usage by fintech businesses and banks, even though many APIs are branded by the companies who built and own them. White-label APIs allow banks and other financial institutions to use financial technology without having to build their privacy policies or applications.

Regulation

Regtech, or regulatory technology, is becoming a more significant part of fintech. Businesses must be able to verify that their consumers are who they say they are. Programs that enable biometric identification, such as fingerprint or iris scanning, to Know Your Client verification programs are all examples of Regtech APIs.

Why APIs Are the Future of Fintech Innovation

- Maintenance and enhancement of the digital ecosystem. Since APIs are the backbone of this ecosystem, it allows companies to maintain strategic partnerships and, consequently, to scale swiftly and productively.

- Agile guidelines. During today's fast-paced workplace, flexible principles are fundamental to primary business systems. According to a recent Google Cloud survey, fintech and insurance companies that use APIs profess more accelerated modernization and utility from market collaborations than companies that don't.

- Greater customer experience. APIs enable businesses to provide a fully seamless sophistication to their consumers, and integrating APIs into a platform empowers businesses to rapidly and simply introduce new goods and services.